What is a Gold IRA?

Individual retirement accounts (IRA) come in various forms to increase a person’s wealth over time. Most IRAs involve stocks and bonds, but precious metals are a separate market where others can invest for more diversification.

Now, people have a chance to invest in metals in their physical forms, such as bullion coins with a self-directed IRA. Gold IRAs are the most popular. Since 1997, you have been able to invest in gold, silver, and other metals.

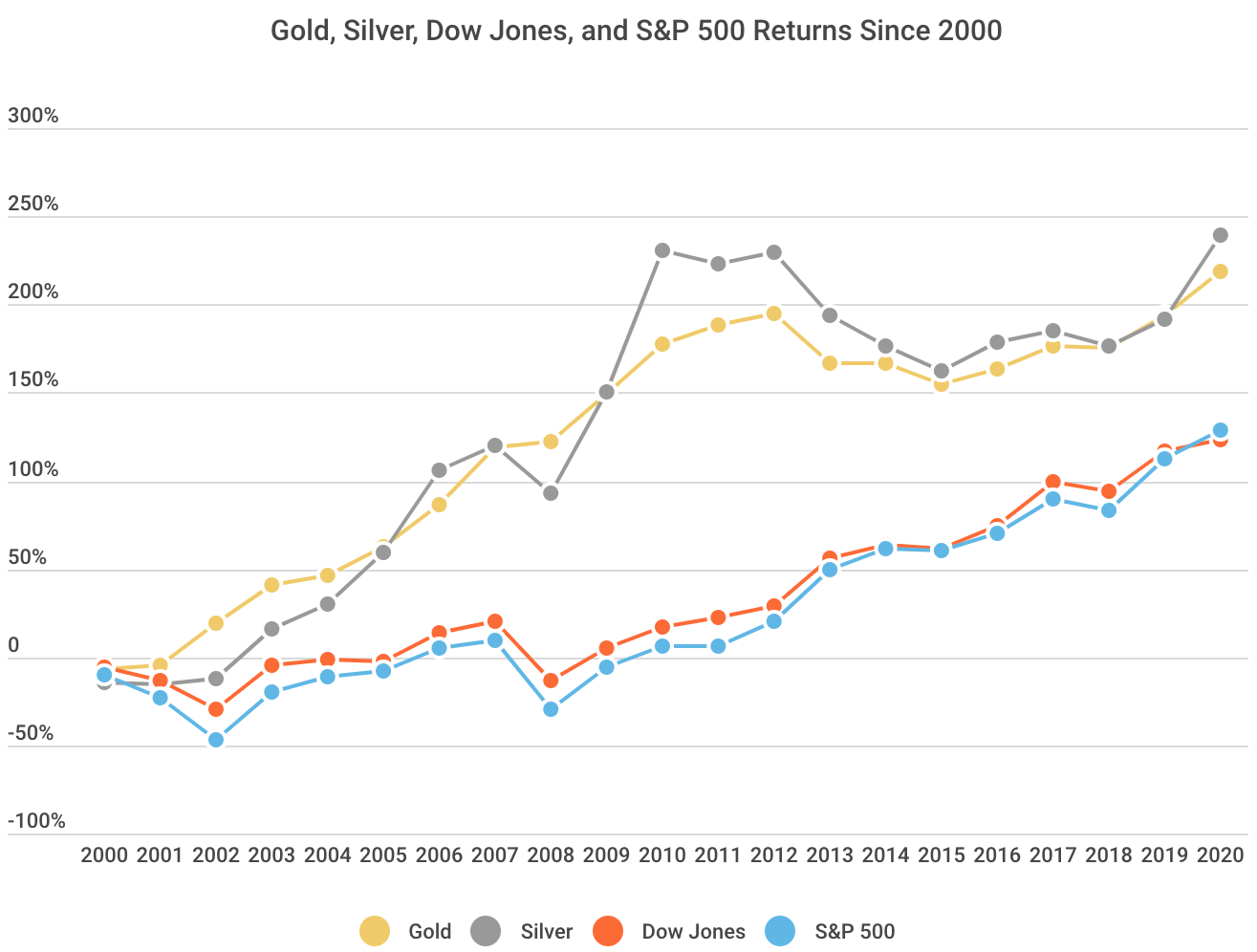

Gold IRAs did not become mainstream until recently. Gold itself has seen stable prices since the 70s. However, with economic uncertainty such as the Great Recession and COVID-19, gold has become a “safe haven” asset.

Overall, people’s investment choices have expanded, providing more opportunities for retirement. However, gold IRAs present a unique opportunity not seen with stocks and other instruments.

Gold IRAs for Economic Downturns

Since the Great Recession in 2008, with people seeing their retirement accounts wiped out as stocks dived, investors have become wary. Investing anxiety is at an all-time high, with people wary of putting their cash into anything other than a savings account.

People are looking for more stable investments but do not look into the precious metals market, as it’s not as popular as stocks.

However, gold is gaining traction because of its inverse relationship with paper assets. For instance, as the dollar decreases, the price of gold increases. As a result, with increasing inflation, people invest in gold to hedge, called an inflation hedge.

An individual retirement account has been the go-to for retirees, with a Gold IRA emerging as the front-runner for investing in economic crises.

Advantages of a Gold IRA

- Price of Gold Continues Rising - Gold’s price per ounce has increased by a tremendous rate that stocks have yet to achieve. For instance, gold rose by 700% within 12 years, from 1999 to 2011. The price kept rising even through the Great Recession.

- Safeguard Against Inflation and Crises - Gold is not affected by inflation like the dollar. Paper assets have an inverse relationship with precious metals and other safe-haven assets.

- Expand Your Portfolio - Opening a precious metals IRA allows your portfolio to be diversified. A traditional IRA is filled with assets prone to market crashes. Securities such as bonds are not enough to protect retirement savers and investment owners, and people are looking towards gold to expand their portfolios.

- Tax Benefits - Like most IRAs, you will receive tax benefits as long as the gold stays in your retirement account. Withdrawing your profits early from the account or taking possession of bullion will subject you to tax penalties.

Steps to Open a Gold IRA

-

Sign Up for a Self-Directed IRA

To begin investing in gold and other precious metals, open a self-directed IRA with a reliable gold IRA company that can help you navigate the steps of setting up an account, choosing a custodian, selecting gold and silver for your account, then getting it sent to a secure depository.

-

Select a Custodian

Custodians are available that specialize in gold individual retirement accounts, and they must report to the IRS.

-

Purchasing Bullion

After your IRA is ready, it’s time to start investing. Deposit money into the account where a custodian will oversee the transactions.

You will work with your gold IRA company to purchase bullion bars or coins on your behalf with your custodian. Besides physical gold, you can choose silver, platinum, or palladium as well.

-

Storing Bullion in Gold IRA

After purchasing bullion bars or coins, the custodian places them in a licensed storage facility.