Details

-

Design

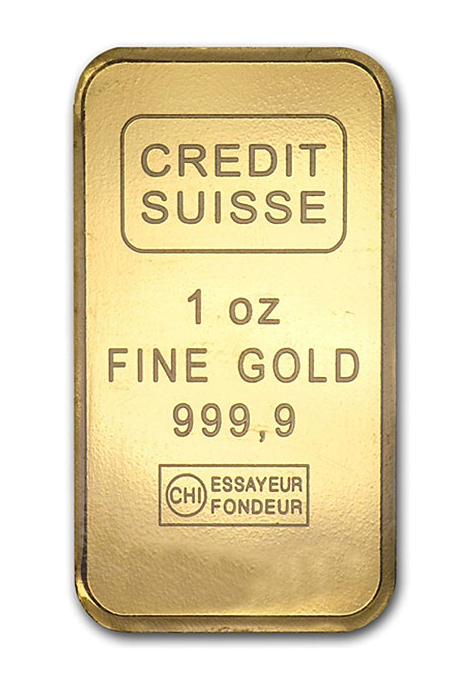

The obverse side of Credit Suisse’s bar features purity and weight information, besides the Credit Suisse logo and the Essayeur Fondeur trademark. The reverse features multiple miniature versions of the logo.

-

Minting

Valcambi SA (Societe Anonyme), a wholly owned subsidiary of European Gold Refineries, mints Credit Suisse’s gold bars under an exclusive contract. The gold bar’s minting began during the late 1970s/early 1980s and has been continually in production since then. There is, however, no clear data on the number of bars produced a year.

-

Quality Guarantee

Credit Suisse’s gold bars have a unique serial number and backing of the Switzerland government. Not to mention, Credit Suisse is a reputable name. All things put together, the quality and authenticity of the gold bar are unmatched.

About Gold coins

Gold bars are usually not as popular as gold coins. They don’t have as much collector value due to their plain designs and little historicity. Another issue is the handling and shipping charges associated with them. Because gold bars are bigger and heavier than bullion coins, their shipping costs are comparatively high. Not to mention, gold bars are usually not shipped easily to different places like gold coins. Moreover, there’s always the risk of damage to the bar during transit since it’s fine gold.

Few gold bars, however, manage to overcome these buyer scruples and grab the prospective buyer’s attention. One such gold bar is the Credit Suisse bar. The bullion bar is arguably one of the few globally recognized gold bars in the world. The design is not particularly special, and the bar’s shape is also not incredibly unique. The name “Credit Suisse,” however, holds cachet, and is one of the major reasons the gold bar is so coveted within the investing space.

If you’re looking to buy Credit Suisse’s gold bars but would like to know more about the item before putting money down, you’re in the right place. To help you understand the bullion bar better, we’ve thrown light on the following:

- A general overview of the gold bar and its backing firm (Credit Suisse)

- The bar’s design, purity, sizes, etc.

- Why and which size variant should you buy

- The value of the gold bar, market prices, and more

If you ever needed a complete lowdown on Credit Suisse’s prestigious gold bar, this is the article to read and get enlightened.

About Credit Suisse Gold Bar

Credit Suisse’s gold bars set the standard for bullion bars. They stand out in the world of overtly simple gold bars. The Credit Suisse bars were launched in the wake of the public’s growing interest in precious metal investments. The first Credit Suisse bar was made in 1979 and has been in production ever since.

Valcambi has been making the bullion bar ever since its inception. The Swiss precious metals refining business was a fully owned subsidiary of Credit Suisse. In 2003, however, European Gold Refineries (a wholly owned subsidiary of Rajesh Exports) fully acquired Valcambi. Despite the change in ownership, Valcambi continues to make gold bars for Credit Suisse.

About Credit Suisse

Credit Suisse is a Swiss Bank with a 150-year rich history. Headquartered in Zurich, Switzerland, and founded in 1856, the multinational financial services firm and investment bank has operations in more than 50 countries globally. Credit Suisse is credited with being one of the initial few banks to dabble in precious metals during the 1970s. The decades of experience and expertise render the Credit Suisse brand a name to reckon with in the bullion industry and, of course, other domains.

Besides producing gold bars and other items made of precious metals, the Swiss company offers a range of financial services (investment banking, private banking, wealth management, asset management, etc.). It, in fact, started its journey constructing Switzerland’s railway system. The entity has played a key role in helping create the Swiss Franc, develop the Swiss National Bank, and help enhance Swiss banking’s reputation. Credit Suisse is on the Swiss Market Index, a stock market index for Swiss blue-chip firms.

Credit Suisse Gold Bar Sizes and Specifications

Credit Suisse bars come in varied sizes/weights, ranging from a gram to a kilogram. The size varieties are 1 g, 2.5 g, 5 g, 10 g, 20 g, 1 oz (31.1 g), 50 g, 100 g, 250 g, 500 g, and 1,000 g (1 kg). Because the bars are manufactured in Europe and commissioned by a European bank, metric denominations are also used to denote the bar’s weight. The bars are not legal tender and, therefore, bear no face value. Irrespective of the size, they are all 99.99 percent pure gold.

Why Invest in a Credit Suisse Gold Bar?

Credit Suisse bars are pure gold, durable, and among the most popular gold bars. Most importantly, they are minted by the most recognizable brand in the world of bullion and coinage. Like how most things Swiss-made have a heightened image and value, Credit Suisse’s bar is also well-regarded or guarantees gold bullion of the highest standard.

Credit Suisse’s gold bars are highly pure (99.99 percent at least) and investment grade. The LBMA (London Bullion Market Association), a global authority for gold, silver, and other precious metal bullion products’ quality and standards, recognizes Credit Suisse’s gold bars. Credit Suisse bars are sold at a lower margin compared to gold coins, meaning lower prices for the buyer, especially when you buy the bigger size bars (1 ounce, 10 ounces, 100 grams, and 1000 grams).

Credit Suisse bars are recognized globally and enjoy a high acceptability rate among gold investors and dealers. In other words, the bars are highly liquid. And because the bar is fine gold, its value is intricately linked with the market price of gold. Besides value, Credit Suisse bars assure safety and security. They are made in a protected facility and come in tamper-proof packaging, making it easy to store them. All these are reasons you should consider investing in Credit Suisse’s gold bar.

Credit Suisse Gold Bar Design

Credit Suisse’s gold bars have an elegant design. The front of the bar features the Credit Suisse logo, purity and weight details, the special trademark “Essayeur Fondeur,” and a unique serial number. The back of the gold bar is dotted with a patterned placement of multiple diagonally positioned Credit Suisse logos.

Credit Suisse Gold Bar Metal Contents

Credit Suisse’s gold bars are pure gold (99.99 percent)—that is as pure as it gets. The purity and metal content information are engraved on the gold bar. The precious metal bar undergoes melting and chemical treatments to eliminate purities and achieve the highest quality. Besides other aspects, the gold bar’s purity is one of the major reasons it’s so trusted and widely recognized.

Credit Suisse Gold Bar Value and Prices

Since Credit Suisse’s gold bars are 99.99 percent gold, they are valued based on whatever the existing price of gold is. Unlike precious metal coins, gold bars don’t require as much resources and time for the design. As a result, they are usually sold at a lesser premium or their prices are usually close to gold’s spot price. As of January 2023, a 1-ounce Credit Suisse gold bar trades at just above $2,000 or €1,800. A 10-ounce bar sells for $19,600 or €18,000. To learn the prices of all variants of the gold bar, click here.

Credit Suisse Gold Bars: Where to Buy

Credit Suisse bars of all sizes and weights are available for purchase on Credit Suisse’s official e-commerce website. Do note that Credit Suisse doesn’t ship the product globally, but it supports multiple currencies and even cryptocurrencies. If you live in the United States, for instance, you might not be eligible to shop at the site. You can, however, consider third-party vendors such as JM Bullion. If you live outside Europe and the U.S., look at APMEX. If your country is not mentioned on the list of countries APMEX ships to, contact APMEX support.

Which Credit Suisse Gold Bars Variant Should You Buy?

Since Credit Suisse bars come in varied sizes, you need not buy the bigger bars if you cannot afford one. The affordable price of the one-gram bar makes it more accessible or easy to add one to any investment portfolio.

As far as which variant or size you should buy is concerned, it depends on your investing needs and goals. The 1-ounce version is the most popular variant as it’s the right balance between size, cost, and value. The coins denoted in ounces are popular as they cater more to the American markets where the bar is extremely popular.

Conclusion

To conclude, Credit Suisse’s gold bars are premium, high-quality, investment-friendly pure gold items. The quality, purity, and brand recognition of Credit Suisse are major reasons the bullion bar is highly sought after within the investor community. And because Credit Suisse bars are pure gold, they can be bought under an IRA, which makes the yellow metal bar ideal to save money for retirement. If considering buying the gold bar, check out the website links above. Your only job as a buyer is to determine the gold bar quantity, right sizes, and check if the vendor ships to your place.

FAQs

Are Credit Suisse gold bars IRA eligible?

Yes, Credit Suisse’s gold bars are allowed within a precious metals IRA (individual retirement account) setup since the bar meets the IRS’ purity requirements and is made in a renowned and reputed precious metal refinery firm. The precious metals IRA requires its bullion to be at least 99.5 percent pure. Credit Suisse’s gold bars are 0.9999 fine.

Are Credit Suisse bars a sound investment?

Yes, Credit Suisse bars are a solid investment, particularly if you’re keen on pure gold articles and not interested in paying the premium for design. Since the price of the bar is fully attached to the value of gold, its value will move very closely, in correspondence to gold’s market value.

Credit Suisse gold bars vs. PAMP Suisse gold bars: What’s the difference?

PAMP Suisse’s gold bars are bars made by PAMP (Produits Artistiques Metaux Precieux) Suisse, an independent company. It is the world’s largest precious metal refinery. Like Credit Suisse bars, Swiss PAMP gold bars are 99.99 percent fine gold and boast the highest quality and artisanship. PAMP bars also come in different weights/sizes. Their designs, however, are more intricate compared to Credit Suisse bars, true to their name.

The front of PAMP Suisse bars is straightforward and informative. The reverse, however, is more creative, bearing the image of Lady Fortuna, the Roman goddess of fortune and luck. The design is not just iconic and recognized worldwide but is also a sign of authenticity and bears testimony to PAMP quality. In response, Credit Suisse produced the special edition Credit Suisse Liberty gold bar, with a Statue of Liberty image on the reverse. It comes in 1, 2, 5, and 10-gram sizes and caters more to collectors. Its limited nature could mean a slightly higher price than regular Credit Suisse bars.

Credit Suisse gold bars vs. Johnson Matthey gold bars: What’s the difference?

Like Credit Suisse, Johnson Matthey is a credible name. Based in the UK, it’s a major gold bar manufacturer and gold refiner with operations in more than 30 countries. Like Credit Suisse, the company also made 24-karat gold bars in multiple sizes/weights. The variants, however, may not be as diverse. The designs or inscriptions are obviously different. It’s worth noting that Johnson Matthey gold bars are no longer in active production. You’d, however, find them in secondary markets.

How can you tell a fake Credit Suisse gold bar?

Since Credit Suisse bars are extremely popular and do not have intricate designs, there are several counterfeits of the bar. As an aware investor, it’s your responsibility to avoid fakes. Buy the bar from a reputable precious metal or gold bullion dealer. Some sellers provide an assay card and a certificate guaranteeing the bar’s authenticity.

The bigger bars may omit the assay card and have a unique serial number stamped on them instead to prove legitimacy. The serial number is verifiable at Credit Suisse. Do note that the availability of assay cards and serial numbers varies with the bar size and seller. For authenticity confirmation, however, it’s recommended you get a spectrometer testing done by a precious metals’ specialist.

What is a Credit Suisse gold bar worth?

Since Credit Suisse’s gold bars are made of pure gold, it is worth its weight in gold. The actual value of the piece will vary depending on the bar’s size, popularity, and current gold prices.

Are there Credit Suisse silver and platinum bars?

Yes, there are Credit Suisse silver and platinum bars. The silver bar is 99.99 percent pure and comes in the same size options as the gold bar. But due to their lower popularity, you may not find them all. Moreover, the production of silvery Credit Suisse bars is no longer ongoing. The lower number makes them more valuable, causing their value to spike and sell for a price greater than regular silver.

Regarding Credit Suisse platinum bars, they don’t come in as many sizes as the other two precious metals. They come in 1-ounce, 10-ounce, 1-gram, 5-gram, and 10-gram sizes. The platinum bars are 99.95 percent pure. Like the gold variant, it has the special Liberty version also. Both the platinum and silver variants have excellent finishes and the details are cleanly etched out.

There are Credit Suisse palladium bars as well. They are 99.95 percent pure palladium and come in 1 and 10-ounce sizes. Here’s the one-ounce version.