Gold: A Complete Guide to the Precious Metal

Only a few human discoveries have been as valuable and coveted as gold. Gold has been revered for one doesn’t know how many centuries, and it continues to enjoy its status to date. Although the world has gone through many wars, industrial reformations, financial turmoils, technological advances, etc., gold has stood steadily.

Back in the ancient times, gold was used as currency. Once gold’s unparalleled chemical properties were discovered, people started to use gold in multiple applications. The increased and varied usage and difficulty of mining or producing new gold made the yellow metal extremely valuable. Realizing the investment potential, several gold-based financial products flooded the market.

But how well do we know gold? Do we know the chemical makeup of the valuable metal or its history? What has gold’ss journey been like over centuries and civilizations? This article intends to answer these questions and cover a lot more. To gain comprehensive knowledge, this guide will focus on the following topics:

- A brief introduction to gold

- A deep dive into gold’s history

- The precious metal’s chemical and physical properties

- Investing in the precious metal

- The practical uses of gold and more

This article may humble you if you consider yourself a gold expert and thought you couldn’t know gold any better. So, read on to get enlightened.

Table of Contents

Gold: A Brief Overview

Gold (symbol Au) is a naturally found chemical element. It’s orange-yellow in color, bright, dense, soft, ductile, and malleable. Very few chemical elements are so versatile in their purest forms. Gold is the least reactive of all chemical elements. It’s a transitional metal and stable in standard environments. Gold dissolves in mercury and cyanide’s alkaline solutions, used in electroplating and mining.

Gold is believed to have been first discovered in 3000 BC. Humankind likely knew about the precious metal's existence much earlier. Kings (such as King Croesus), monarchs, and other wealthy individuals from the ancient past typically had significant gold holdings. Gold has historically been used for jewelry, coinage, etc. Gold bullion coins were minted as currency till the 1930s.

Gold bullion coins were used as currency in several ancient societies, including Egypt, Greece, and Mesopotamia. The metal’s recognized value and uniformity rendered it reliable for conducting trade. As economies took shape, gold coins were standardized, bearing specific purities and weights. Merchants and traders could easily carry gold coins across borders without depreciation fears.

Gold is limited in supply, and most of the gold mined to date has been in South Africa, Australia, China, the United States, etc. Gold is naturally found as grains or nuggets in alluvial deposits, veins, rocks, and minerals like pyrites. It’s naturally alloyed with copper, palladium, and other metals. In the commercial or retail form, gold can be bought as gold coins, bars, leaves, jewelry, etc. Not to mention, the purity levels or how the amount of gold present in the article will vary.

Gold: The Chemical Element

Gold is one of the eight noble metals, which also include silver, platinum, palladium, and rhodium, to name a few. The chemical symbol for gold is “Au,” and its atomic number is 79. The chemical symbol Au is based on the Latin “aurum,” a term that means “glow of sunrise” or “shining dawn.” “Gold” is an Anglo-Saxon word.

The gold symbol represents gold on the periodic table. The atomic number 79 signifies the presence of 79 protons in a gold atom’s nucleus (center portion). The transition metal belongs to Group 11 and Period 6, positioning it with other transition metals such as copper and silver. Gold’s placement on the periodic table denotes the metal’s chemical behavior and atomic structure.

Here is an overview of gold’s chemical attributes:

| Color | Metallic yellow |

| Atomic number | 79 (79 protons in a gold atom’s nucleus) |

| Atomic weight | 196.97 amu (atomic mass units) |

| Boiling point | 2,966 °C (5,371 °F) |

| Melting point | 1,063 °C (1,945 °F) |

| Density | 19.32 grams |

| Periodic table group | Group 11 (transition metal) |

| Periodic table period (row) | 6th |

| Conductivity | High (thermal and electrical) |

Notes:

- The 19.32-gram density denotes the total mass of gold packed in every milliliter or cubic centimeter.

- The sixth-row positioning of gold on the periodic table denotes the gold atom has six electron energy shells or levels around its nucleus.

Read more: Is Gold Magnetic?

Gold: Properties/Characteristics

Below are some key attributes of gold explained in detail.

Inert and Biocompatible

Gold’s “biocompatibility” denotes its ability to coexist with living organisms and other biological systems without causing adverse effects or harmful reactions. In other words, gold doesn’t elicit toxic reactions or major immune responses when contacting biological tissues. On the other hand, the precious metal’s “inertness” denotes it is chemically unreactive or inactive under particular conditions. Gold doesn’t readily react with moisture, oxygen, bases, acids, etc., commonly encountered in environmental or biological settings.

High Malleability

Gold could be hammered, pressed, or rolled to great lengths without causing it to crack or break. One gram of gold could easily be beaten into a square meter sheet. This incredible malleability allows gold to be elongated as thin wires or pounded into thin sheets. A gold leaf can be hammered to look semi-transparent. Note that gold’s malleability is subject to ambient temperature. If it’s freezing, the yellow metal could become less malleable and more prone to breaking or cracking when stretched or struck.

Good Conductor of Heat and Electricity

Gold is an excellent conductor of electricity and heat. This innate attribute is thanks to gold’s atomic structure and electron configuration, affording the metal with specific heat capacity. Gold’s good electrical conductivity means the metal permits electric current to flow with minimal resistance.

A gold atom’s valence shell is partially filled, allowing electron movements with little resistance. This strong electrical conductivity stays stable throughout, including in varying environmental scenarios. On a related note, use the Pauling scale to determine an atom’s tendency to attract electrons within a chemical bond.

Gold’s excellent thermal conductivity can also be attributed to the atomic structure and the behavior of the electrons. Gold’s ability to absorb heat and transfer that energy deems it a solid heat conductor. Gold’s high thermal conductivity of 315 W/m.K (watts per meter kelvin) ensures heat spreads uniformly and promptly through the precious metal. This high thermal conductivity is utilized in different applications, such as heat sinks in thermocouples, electronics, aerospace components, etc.

Gold is Unreactive

Gold doesn’t react with oxygen, irrespective of the temperature. Gold, however, could react with elements such as bromine, sulfur, and iodine. However, the interactions are usually indirect and slow. Rarely does gold respond with a chemical element directly. For instance, phosphorus instantly reacts with the yellow metal at elevated temperatures, producing gold phosphide. As far as acids go, gold is not affected by most, including hydrofluoric, sulfuric, nitric, or hydrochloric acid, to name a few. Aqua regia (hydrochloric and nitric acid mix) dissolves gold.

The Color of Gold

Although gold looks yellow, it’s not precisely that. There’s a slight reddish hue to the yellow. When mixed with other metals, such as silver and copper, the soft metal assumes different shades, such as pink and white. When other metals are added to gold, there’s a dip in purity or karats. A 24-karat piece is the pure form of the metal. You're looking at gold alloys if the karats are 20, 18, 14, etc. As the karat figures drop, the gold metal stops looking its trademark bright yellow. To learn more about karats and how they differ from “carats,” click here.

Practical Uses of Gold

Gold is primarily associated with jewelry making. It can lay the base for or be customized with engraving, gemstones, and other embellishments, adding a sentimental and personal touch to the accessory. Gold’s non-reactive traits and luster are invaluable in jewelry, decorative coatings, and luxury watchmaking.

Due to the precious metal’s high ductility, malleability, corrosion resistance, and electrical conductivity, gold’s usage spans multiple industries and applications. The noble metal is used in various computerized gadgets, infrared shielding, colored glass manufacturing, tooth restoration, and gold leafing. Gold salts could be used in medicine as anti-inflammatories. The thin gold wires are commonly used in dentistry, electronics, and jewelry. Let’s discuss them all in detail.

Jewelry

As stated earlier, gold’s natural warmth and luster lend it a timeless allure. The precious metal complements different outfits and skin tones, deeming it versatile for special occasions and casual wear. The yellow metal could be crafted into various styles, from intricate and delicate patterns to upfront statement pieces. Gold is versatile and accommodating as a metal, functioning as a base for jewelry-making techniques such as filigree, stone-setting, enameling, and engraving.

As alluded to earlier, gold can easily blend with other precious metals such as silver, platinum, palladium, etc., creating multi-tone, two-tone, and colored gold forms, like rose and white gold. Gold also paves the way for minimalism. Minimalist gold jewels have grown increasingly popular, with stackable rings, delicate necklaces, simple bracelets, etc., garnering attention. Not to mention, layering these different pieces provides depth and personalization to any style.

Geometric pendants, clean lines, angular forms, and the like produce minimalist and modern aesthetics. Asymmetrical gold earrings create a contemporary and edgy look. Not to mention, jewelry is on an ongoing path of change and evolution. And with gold lending its allure and no-fuss character, one can anticipate all kinds of innovation in the space.

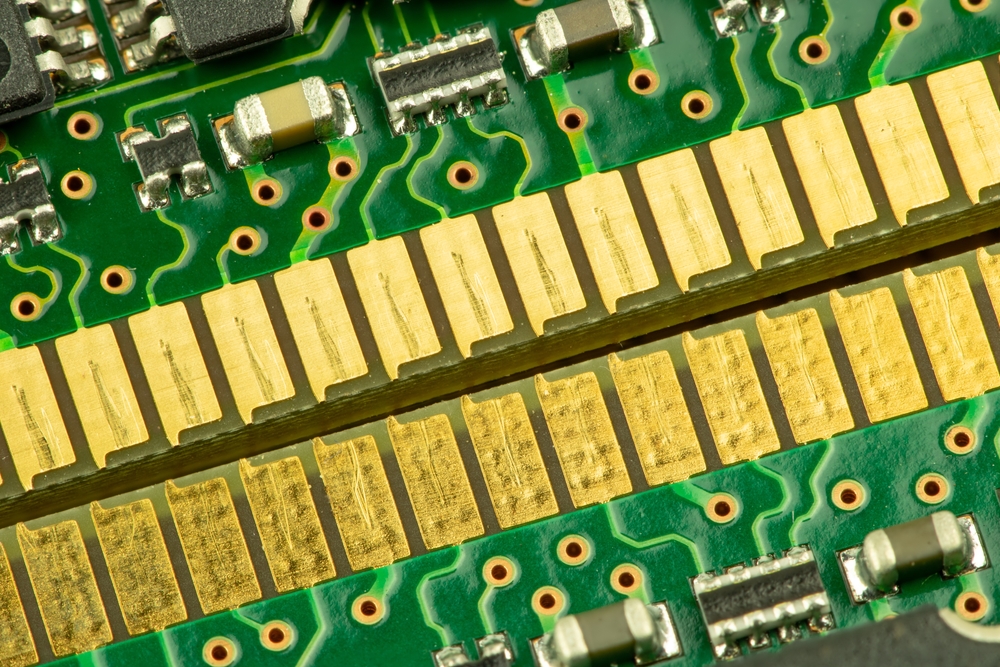

Electronics

Gold is highly resistant to oxidation and corrosion, even when exposed to high-moisture environments and particularly corrosive agents. Since gold doesn’t corrode and is a strong conductor of electricity, it becomes a crucial component in smartphones, tablets, TVs, computers, and other electrical devices. Gold is usually plated onto electrical copper components employed in switches, connectors, printed circuit boards, computer chips, etc., to ensure efficient and reliable electrical conductivity.

Gold’s high malleability and ductility means you can easily elongate the precious metal into thin wires and shape it into complex forms without breaking. The yellow metal’s superior thermal conductivity lets it effectively dissipate heat, thwarting electronics from overheating. Gold-plated sockets and connectors help with maintaining connectivity and preventing oxidation-related problems.

Gold is employed in the SIM card slots and charging ports of smartphones. The precious yellow metal is also used in touchscreens because of its durability and electrical conductivity. Gold helps plate PCBs (printed circuit boards), critical to transmitting signals between parts. Gold is used to produce CPUs (central processing units) and RAM (random-access memory) modules.

Medical and Dental

Gold is well-tolerated by the human body, making it ideal for medical and oral applications. The yellow metal’s inertness and biocompatibility make it ideal for implants, stents, pacemakers, defibrillators, and other medical devices. Due to its stable electrical traits, medical equipment uses gold for applications such as electroencephalography (EEG) and electrocardiography (ECG). Gold nanoparticles are employed in drug delivery, diagnostic imaging, cancer treatments, etc. Gold could also be found in artificial limb joints.

Gold nanoparticles help enhance computed tomography (CT) scan images, offering more precise visualization of organs and tissues. The nanoparticles can also be used in cancer treatments. Gold compounds are used as DMARDs (disease-modifying antirheumatic drugs) to remedy rheumatoid arthritis. They reduce inflammation, decelerating disease advancement. Gold nanoparticles help detect HIV antibodies.

The high surface area and small size of gold nanoparticles help with loading and controlled drug release. They can transport drugs to particular areas in the body, boosting drug effectiveness and decreasing side effects. Gold nanoparticles can be used in biosensors for detecting specific pathogens or biomolecules. The biosensing tool could diagnose disease, oversee treatment responses, and detect infections early.

Thanks to its non-reactiveness and durability, gold is used in dental fillings, bridges, and crowns. The yellow metal helps manufacture dental crowns as it is biocompatible, durable, and easy to manipulate. The biocompatibility ensures zero irritation caused to the oral tissues. Gold crowns may not be as common now, but they were once highly praised for their endurance and ability to safeguard the closest teeth. The precious metal is used in braces, retainers, and other orthodontic appliances.

Aerospace

Materials coated in gold can be found in satellites and spacecraft, reflecting and radiating heat and ensuring stable temperatures in extreme conditions. The gold-coated visors spacesuits use safeguard astronauts’ eyes from dangerous solar radiation while facilitating clear vision. Aerospace equipment, such as the cables and electrical connectors, use gold for the metal’s exceptional electrical conductivity.

Gold is employed in the circuit boards of avionics systems and other aerospace electronics to decrease signal loss and maintain signal integrity. The solar panels on satellites and spacecraft use gold films or coatings on their surfaces. The gold cover reflects and directs sunlight onto the photovoltaic cells, enhancing energy conversion efficiency in the space with limited sunlight. Gold-coated reflectors and mirrors are used in spacecraft sensors and optical instruments.

Telecommunications

Gold plays a significant part in telecommunications due to its strong corrosion resistance. Electrical conductivity ensures reliable performance even in demanding scenarios. Gold coatings are used in telecommunication equipment to maintain clear and reliable communication. Fiber-optic lines use gold-coated switches and connectors to mitigate signal degradation and ensure proper data transmission.

Telecom relays and switches use gold. The metal’s low contact resistance helps the buttons function efficiently and reliably. Gold is used in telecommunication system antennas to optimize RF (radio frequency) signal reception and transmission. The gold coating boosts the antenna’s conductivity and reduces signal loss. Long story short, telecommunications equipment need to function 24/7. The efficiency and reliability provided by gold-coated circuits and components help keep the operations up.

Others

Gold nanoparticles facilitate catalysis or accelerate chemical reactions. Gold helps produce specialized glass for radiation protection, spacecraft windows, and other applications. Research is underway to understand gold’s potential role in enhancing processing and data storage in quantum computing and other emerging technologies. For example, gold layers coat quantum computer parts to achieve near-zero temperatures and boost performance.

Nanoparticles of gold could function as lubricants in specific scenarios, decreasing wear and friction in certain mechanical systems. In the past, gold was used to develop photographic prints and films. The advent of digital photography has minimized that use. In solar panels, gold-coated reflectors help improve efficiency, reflecting and directing light on the photovoltaic cells.

Ancient Usage of Gold

During ancient times, gold was used to make religious and cultural symbols. Rulers and gods were adorned with gold ornaments. Ceremonial items, such as crowns and scepters, and objects used in rituals signified a religious leader or ruler’s authority. Temple facades and other architectural elements had gold incorporated into them. The barter system was replaced with gold coins used as currency.

Gold dust or leaf was used to add a luxurious and radiant finish to sculptures, paintings, and manuscripts. Artworks gilded with gold were particularly popular in Renaissance and medieval art. Gold and its lustrous shine helped embellish the paintings' borders, frames, and other decorative aspects. It’s worth mentioning that gold is being continually used to beautify and adorn objects—also, gold-embellished architecture features in several iconic temples, buildings, and palaces globally.

Our ancestors used gold jewelry as a medium to infuse their cultural symbols and communicate their artistic styles. Gold jewelry has carried cultural narratives for different ancient societies. Gold helps establishments assert authority through these varied applications, leaving a lasting impression.

Types of Gold Investments

Gold can be bought in the metal or through investments based on gold, such as ETFs (exchange-traded funds), mutual funds, stocks, etc. Let’s discuss them in some detail.

Physical Gold Investments

When the masses think of buying gold, the first thing that hits their mind is jewelry. The jewelry form is undoubtedly apt if you want to wear and flaunt gold. However, buying jewelry for investment reasons is a loss-making exercise. Look at gold bars and coins instead for investing and growing your wealth.

Don’t get us wrong. Gold jewelry can also be an investment asset. But it’s more ornamental and doesn’t offer the returns pure gold items provide. Read our “Physical Gold: A Complete Guide” piece to learn more about investing in and buying physical gold. If you’d like to learn more about buying gold jewelry and why it’s not cut out for investment, click here.

Gold bars and coins come in different sizes and weights—anywhere between less than a gram to multiple kilograms. Gold bars are usually 99.99% pure. Gold coins can be less pure, or there could be 22-karat versions, such as American Eagle Gold coins. Also, unlike gold bars, bullion coins could carry a slight premium over their melt values due to their design, collectability, etc.

Besides the above, physical gold is also available as rare or numismatic coins. These are gold bullions usually valued higher than their melt prices. Their unique design, historicity, cultural significance, collectability, etc., could be the reasons behind the more significant market value.

Paper-Based Gold Assets

As stated earlier, gold stocks, mutual funds, ETFs, etc., are popular forms of non-tangible gold assets. Those who don’t want to own gold in the metal and put up with its secure storage requirements but want their investment portfolio to have some form of exposure to gold prices opt for such gold assets.

A gold ETF is a fund that tracks gold prices. It offers gold price exposure without owning the actual metal. They instead hold physical gold as underlying assets. Each share or unit of the fund represents a part of that gold. Gold ETFs, like stocks, are traded on the stock market, offering high liquidity. iShares Gold Trust and SPDR Gold Trust are popular gold ETFs. To learn more about gold ETFs and how they work, click here.

A gold mutual fund is a pooled fund managed by a fund manager. The fund is invested in multiple gold-based assets, such as gold ETFs, mining stocks, and futures. The mutual fund’s investment strategy and goal could vary depending on the management’s approach, not always precisely mirroring gold prices. A gold mutual fund is usually traded at the given day’s closing price, meaning investors cannot execute intraday trades. To learn more about gold mutual funds and investing in them, click here.

A gold stock, as the name indicates, is a share representing an ownership stake in a company that deals with gold in some way or another. It is usually a gold mining company, so gold stocks are commonly called “gold mining stocks.” Investing in stocks of such firms offers exposure to potential gains from gold mining. But unlike gold ETFs and mutual funds, a gold stock’s price is determined by more than just gold production. Factors include the gold company’s operational and management performance, broader economic factors, global gold demand, etc.

Gold options and futures are another way to invest in paper gold. They, however, are a lot more complex and not ideal for “investing noobs.” These derivative agreements entail speculating on future prices of gold without owning gold in the metal. Not to mention, the investment vehicle carries higher risks and warrants solid knowledge about market dynamics.

Then, there’s “gold IRA.” It’s different from the above and strikes a balance between physical and non-physical gold. It’s a significant topic, and we’ve covered various facets of it already. Kindly browse our site for the multiple articles written on the subject. To get started, click here.

Gold certificates, gold-based cryptocurrencies, etc., are other ways to gain exposure to gold prices without owning the metal.

Investing in Gold: The Reasons and Drawbacks

Unlike paper assets or fiat money, gold is inherently valuable. It may not boost an investment or retirement portfolio’s growth prospects, but it helps steady the ship when the growth drivers struggle. That’s because gold price movements have minimal correlation with stocks, bonds, and other traditional assets, reducing overall portfolio risk.

Gold functions as a solid hedge against inflation. With living costs increasing, the gold value also increases, protecting purchasing power. Therefore, when markets crash or during financial crises, gold serves as insurance or offers stability while other assets decline.

Gold is globally recognized and accepted. It’s a very liquid asset. Irrespective of the part of the world, it’s never too difficult to buy, sell, and trade gold in any global market. Also, gold is finite. As stated earlier, manufacturing new gold is not practical. This natural scarcity lends to the long-term value of the ductile metal.

Not everything’s good with investing in gold, particularly physical gold. The biggest concern is secured storage. Gold coins, bars, jewelry, etc., need secure storage, incurring additional costs. Storage solutions come in the form of third-party vaults, personal safes, etc. Bank vaults have recurring fees. Home safes, on the other hand, are not as secure.

Another major drawback is the lack of returns during ownership. Unlike stocks and mutual funds that pay dividends or interest income, gold doesn’t provide monetary benefits when held. Capital gains or appreciation in value can be realized only during trade. Even real estate or investments in businesses provide rental income or regular cash flows, respectively.

And although gold is financially liquid, its level of fluidity hinges on supply-demand dynamics and market sentiment. Moreover, finding potential buyers for collectible or unique gold pieces could be even more challenging as they are niche, or most may need to learn more about them to appreciate them.

Gold Price Determinants

Although gold is intrinsically valuable, several external factors influence the precious metal’s market value. Supply and demand influence prices the most. It’s basic economics. If the demand for the yellow metal exceeds the supply, prices will increase, and vice versa.

The financial market and global economic indicators play a role as well. In other words, employment rates, interest rates, inflation, and GDP growth can influence gold prices. Financial downturns and economic uncertainties often push investors to seek refuge in gold.

Central bank decisions on monetary systems and interest rates can impact the price of gold. Lower interest rates could render gold and other non-interest-generating assets more attractive, causing higher demand. On the other hand, a stronger currency will make gold more expensive to procure, leading to reduced demand and prices. That said, a stronger or weaker currency doesn’t always correlate with an increase or decrease in gold prices, as other factors could influence it.

Changes in the gold reserves of central banks could influence the gold market’s supply-demand dynamics. Psychological factors and market sentiment could impact gold prices significantly. Besides macroeconomic elements, geopolitical events, such as political instability, geopolitical tensions, etc., can cause an increase in gold demand.

Read more: Gold Price Fluctuation

Conclusion

Considering its long and gloried past, gold is classic and will never go out of fashion. The allure will remain until something equally good or better comes along. Bitcoin tried to topple gold’s status, but the cryptocurrency's dynamic and risky nature kept investors at bay. Most importantly, gold is easy to comprehend, appreciate, see, and feel. All things cannot be said for other investment forms. Cryptocurrencies, for sure, are outside the common person’s understanding and cannot be held in the hand.

Moreover, gold is inherently valuable. Almost no other investment vehicle comparable to gold is valuable on its own. Other precious metals, such as silver and platinum, although intrinsically significant, are not as popular as gold—not to mention the various uses of gold besides jewelry or investment. Several investment opportunities are around or based on gold reserves.

It, therefore, is understandable why gold continues to be explored and mined and why the yearning to get to know the yellow metal better lives. Hopefully, this article provided all the gold-related information you could have wanted. And feel free to check other articles on our site to delve deeper into specific facets of the precious metal.