Gold Broker Review 2023 – Is it Safe or a Scam?

Read our full review on this gold company

Ranked #26 of 68

Gold Broker

3 / 5

The best about Advantage Gold IRA

-

They provide international storage services.

-

Signing up is simple and safe.

-

They have gold and silver coins available.

Ready to Protect Your Retirement Savings?

Gold BrokerBefore we get started with this review:

-

It is difficult to pick a company you can trust with your hard-earned savings. We understand this, and that is why we create useful information to give you as much knowledge as possible before you make a decision.

To make comparing and choosing a company best suited to your needs as easy as possible, we have created a list of our highest recommended investment companies.

>>CLICK HERE to read our list of the top gold investing companies.<<

Look to see if Gold Broker was selected to our list this year!

Or…

Get a FREE Gold Investing Packet from our #1 recommendation:

Gold Broker Review

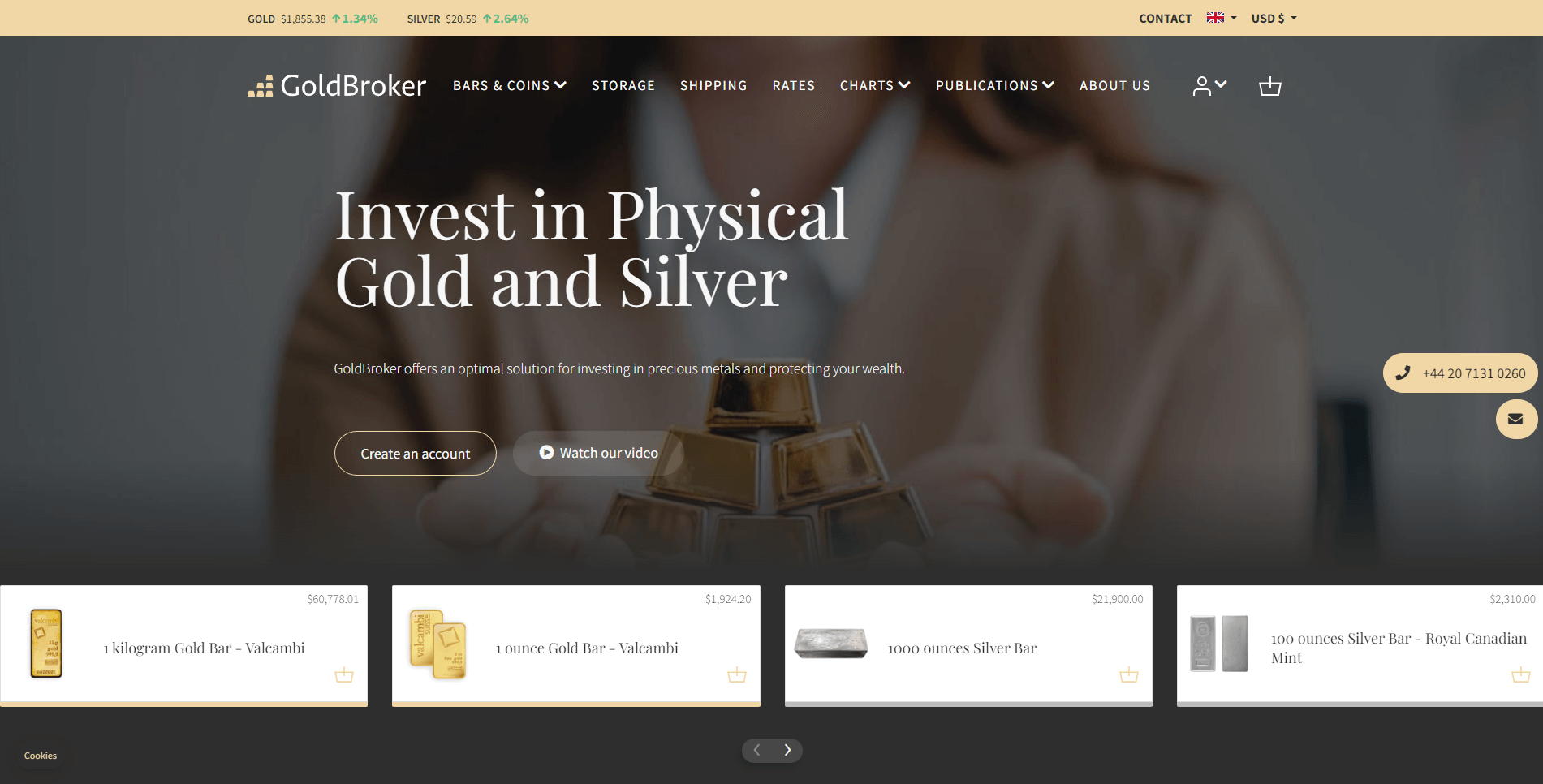

Gold Broker can be said to be a mysterious organization. Finding information on it for the first time can be difficult. To get information on the company, look under its parent company FDR Capital for more details. Gold Broker is a company that deals in bullion and sells gold, silver, platinum and palladium coins and bars. The company's offices are in New York City, Malta and London. Their parent company's headquarters and the location of their other office are in Malta.

The company's main focus is placed on the physically held gold and silver coins and bars that are stored and allocated outside the normal banking system. The Gold Broker Company also offers secure storage for precious metals in Canada, Singapore and Switzerland. The company's main strength and purpose is the goldbroker custodian, storage facilities and its offshore and discreet storage options for investors for their gold and silver bars. The company's vision is to help precious metals holder store and buy metals easily.

Gold Broker is mainly an online-operated gold storage services company that is easy to use. They sell gold and silver bullion products; coins and bars and a limited amount of platinum and palladium bullion to investors and purchase them with the company's buyback program. The owners of precious metals keep their holdings personally in their name and with full ownership of the metals and no middlemen involved. They offer products mainly in large quantities of 10 gold coins and 500 silver coins, which is a disadvantage to smaller investors.

Gold Broker Review: Our Rating Categories

Our user rating categories for this gold broker IRA review are:

1. Product range and services

2. Pricing

3. Customer care

4. Company reliability

5. Customer reviews

Gold Broker Review: Our Verdict #26

Gold Broker is an online investment platform where clients buy and sell physical gold and silver bullion stored in the company's vaults in New York, Singapore, Toronto and Zurich, outside the traditional banking system. They are top-rated and ranked among the top ten best IRA companies.

Review of Gold Broker: Overall Rating: 3/5

Gold Broker Pros & Cons

Benefits

-

It is easy and secure to sign up with Gold Broker

-

They offer more which includes gold and silver coins.

-

Many options for securing your account, including two-factor authentication, daily backup and encryption, and more.

-

Diversification: Gold is one of the best forms of diversification available today because it’s not correlated to other investments like stocks or bonds. If you buy shares in some company or invest in bonds, then that company or bond could go bankrupt due to bad management, which could cause the stock price to fall sharply.

-

They offer international storage for assets offered in Canada, Switzerland and Singapore.

Disadvantages

-

They limit their coin selection to large orders.

-

They offer limited platinum and palladium products.

-

No published statistics exist on the company's holdings of precious metals or their vault partners.

Gold Broker Review: Key Summary

| Experience | It is a well-experienced company as it has been established since June 2015. The founder and owner of the company are known as top players in the finance industry, so it is a very promising company. |

|---|---|

| Website | Their website is straight to the point and includes important information for potential investors. The homepage consists of an About page, rates, services etc., that provide sufficient information about the gold investment scheme. |

| Client Education | Like other gold investment platforms, they provide educational materials for their clients on their websites. |

| Customer Service | you can contact their customer service through email, text, phone, and website. |

| Available Precious Metals Offer | They offer gold, silver, platinum and palladium |

| Physical Storage | They offer physical storage in vaults |

| Other Investments Available | N/A |

| Annual Fees | Annual fees depend on the precious metal clients invest in. |

| Trustlink Rating | N/A |

| Consumer Alliance Rating | N/A |

The Bottom Line

Gold Broker has been in the precious metals business for over a decade. The company aims to allow investors to buy and store precious metals.

The company's customers range from individuals to other corporations across the globe, but their deals are sometimes the best of their competition. They do not indicate their products' prices; they also have no reviews from past clients on BBB and other platforms. Currently, there are no ratings or accreditation from BBB on the company.

Product Range and Services

Gold Broker Gold IRA offers a wide range of Precious Metals, including selling gold, silver bullion bars and other precious metals. They mostly deal in gold and silver bars and some coins and sparsely in a few platinum and palladium bars. They offer products in larger quantities, like 450-500 monster boxes of silver coins or 10-ounce rolls of gold coins. Recently they started offering smaller sizes of these coins, like one-ounce bars of gold, platinum and palladium, together with the usual large-sized gold silver bars.

The big bars available usually start at 15 ounces of gold and move up to 1,000 ounces of silver. They buy back any product they sell after you contact them and express your wish to liquidate. All of their products are not fit for IRA accounts, and their offshore storage arrangement is also not allowed by the IRS in retirement plans.

Gold Broker Gold IRA Services

Gold Broker Company is an online investment platform founded in 2011 that provides services of holding and storing precious metals in the client’s name, not within the banking system and giving direct access to their vaults.

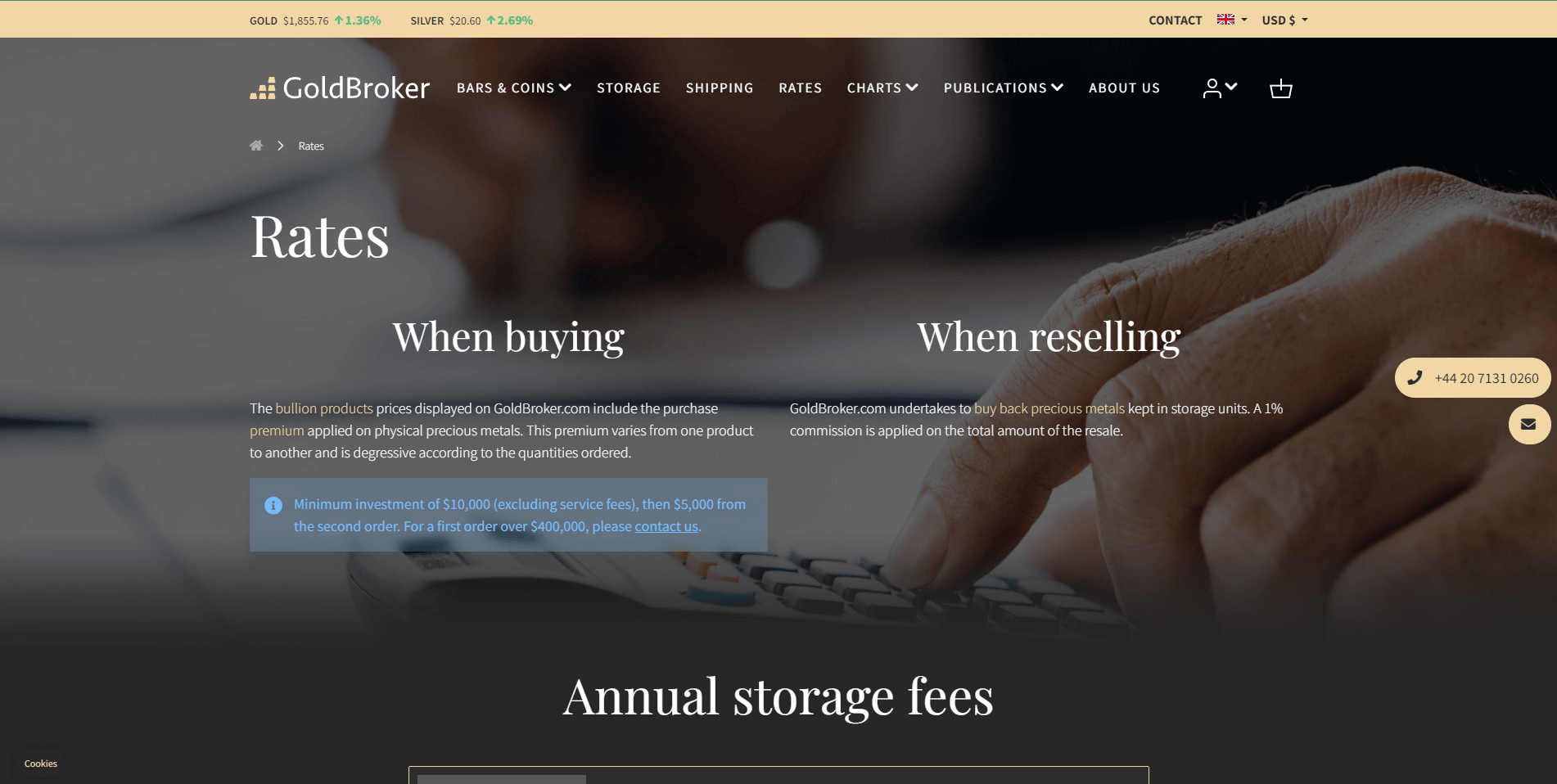

Pricing

Gold Broker Gold IRA is great value for money. They deal in gold and silver bullion and some coins in existing retirement accounts. They have limited options for platinum and palladium too. The storage goldbroker company offers its products in bulk quantities; for example, you could get 10-ounce rolls of gold or boxes of silver coins weighing 400-500 ounces.

Gold Broker usually offers bigger bullion bars that range from 15 ounces of gold bars to 1,000 0unces of silver bars.

Gold Brokers buy back every precious metal they sell to you once you contact them and express your wish to sell and the amount you wish to sell. If buying gold, this is one of the best features you can get on Gold Broker. The pricing of metals depends wholly on what precious metal you wish to buy on the stock market.

Gold Broker Gold IRA Costs/Fees

Gold Broker charges fees based on the type of precious metals the client invests in, be it gold, silver, platinum or palladium; its forms either coins or bullion and the amount of money invested. When you buy gold through bank wire or or sell precious metals, all the rates are shown on the company's site.

However, storage fees differ from those rates for other precious metals transactions.

Minimum Investment

When buying bullion products prices on the Gold Broker website include the purchase premium applied to every precious physical metal. This premium differs for each product and reduces according to the quantities purchased. Apart from service fees, the minimum investment for the first order is $10,000 and $5,000 for the second order.

Customer Care

The company has great customer care, and a finance director. You can contact them via;

Gold Broker Information

Address: FDR Capital LLC, GoldBroker, 300 Park Avenue, 12th Floor, New York, NY 10022

Phone: (800) 780-0350

Website: www.goldbroker.com

Gold Broker Gold IRA Educational Materials

Many gold investing firms have a blog, educational area or news section. Gold Broker's website is fully equipped with educational materials that can aid client education. If you wish to learn about gold investing, there are enough articles on the Gold Broker website to learn from getting started. The FAQ page is fully updated, so there is enough information on the business.

Company Reliability

Gold Broker is a legitimate company that has been in business since 2011. It has sustained its business for more than a decade, and a company that is not legitimate will not be able to survive that long. Furthermore, Gold Broker's founder, Fabrice Drouin Ristori, is a trusted name in the investing industry. He has also owned two other companies related to gamine. He started a private investment company before Gold Broker was founded.

Gold Broker Gold IRA Company History And Background

Gold Broker was founded by Fabrice Drouin Ristori, a French-based investor and entrepreneur, in 2011. After investing for seven years in the investment industry, Ristori sold two companies in 2010 that were founded together with other parties. He had a major problem: how to best invest the money he had gathered in the unstable market and financial atmosphere.

At this point, Ristori's main goal was to focus fully on his entrepreneurial ventures without worrying about managing his other assets. Like a serial saver, Ristori was looking for a way to invest with a good history of stability even within the constant market instability.

Ristori did some research and realized that one of the safest ways to store his assets is via gold, as the value of gold has long been identified to have the ability to stand financial instability. After more research, he came up with a brilliant solution to his problem; he would not tie his assets to paper gold; instead, he would make their physical gold bullion. Also, rather than storing his gold in a bank, he would store it in a safe and reliable storage facility in a politically stable country.

To ensure the safety of his stored assets, he decided to rely on a firm that knew him and allowed him easy and direct access to his vault. A firm that would sign a contract ensured he was the only owner of the physical gold in his vault, with no mediator accessing his assets.

As an experienced investor and researcher, Ristori knew that because of the major money and financial problems, many savers would start investing in gold bullion as it is the best way to safeguard their savings in the long term.

After searching for a long time, Ristori could not find a platform to invest in physical gold with peace of mind, so he decided to found his own company Gold Broker. He used it to protect his assets and also offer a good and quality solution to other savers looking for good physical gold investments to invest their money into.

Currently, the headquarters of the company is located in London. There are 15 employed individuals with the best qualifications and experience to help clients make the right investment choices for their portfolios.

Gold Broker gives free shipping to the U.S. on all gold and silver orders and makes international shipping to France. Any order made is packaged securely with full insurance while shipping. To enhance investment protection, ensure that when the gold or silver is in your hands, you will have a sign for the delivery to collect the package. For any order above $250,000 precious metals, receive the order via armored car service.

Customer Reviews

Gold Broker is a legitimate company that has been in business since 2011. It has sustained its business for more than a decade, and a company that is not legitimate will not be able to survive that long. Furthermore, Gold Broker's founder, Fabrice Drouin Ristori, is a trusted name in the investing industry. He has also owned two other companies related to gamine. He started a private investment company before Gold Broker was founded.

Gold Broker Gold IRA Company History And Background

Gold Broker was founded by Fabrice Drouin Ristori, a French-based investor and entrepreneur, in 2011. After investing for seven years in the investment industry, Ristori sold two companies in 2010 that were founded together with other parties. He had a major problem: how to best invest the money he had gathered in the unstable market and financial atmosphere.

At this point, Ristori's main goal was to focus fully on his entrepreneurial ventures without worrying about managing his other assets. Like a serial saver, Ristori was looking for a way to invest with a good history of stability even within the constant market instability.

Ristori did some research and realized that one of the safest ways to store his assets is via gold, as the value of gold has long been identified to have the ability to stand financial instability. After more research, he came up with a brilliant solution to his problem; he would not tie his assets to paper gold; instead, he would make their physical gold bullion. Also, rather than storing his gold in a bank, he would store it in a safe and reliable storage facility in a politically stable country.

To ensure the safety of his stored assets, he decided to rely on a firm that knew him and allowed him easy and direct access to his vault. A firm that would sign a contract ensured he was the only owner of the physical gold in his vault, with no mediator accessing his assets.

As an experienced investor and researcher, Ristori knew that because of the major money and financial problems, many savers would start investing in gold bullion as it is the best way to safeguard their savings in the long term.

After searching for a long time, Ristori could not find a platform to invest in physical gold with peace of mind, so he decided to found his own company Gold Broker. He used it to protect his assets and also offer a good and quality solution to other savers looking for good physical gold investments to invest their money into.

Currently, the headquarters of the company is located in London. There are 15 employed individuals with the best qualifications and experience to help clients make the right investment choices for their portfolios.

Gold Broker gives free shipping to the U.S. on all gold and silver orders and makes international shipping to France. Any order made is packaged securely with full insurance while shipping. To enhance investment protection, ensure that when the gold or silver is in your hands, you will have a sign for the delivery to collect the package. For any order above $250,000 precious metals, receive the order via armored car service.

Average star ratings

-

Trustpilot: 4.8/5

Gold Broker vs the competition

Gold Broker

Best Customer Reviews

-

Gold, Silver, Platinum & Palladium

-

$10,000

$5,000 non IRA

-

80$

80$ Annually

-

$100

Annually

-

A+

-

AAA

-

None

-

Gold & Silver IRA

-

$25,000

$3,500 non IRA

-

$50 + $30

$100 Admin Annually

-

$150 Segregated

$100 Non Segregated

-

A+

-

AAA

-

Get 10% back in FREE silver

-

Gold, Silver, Platinum & Palladium

-

$50,000

$50,000 non IRA

-

$50

$200 Admin Annually

-

$125

Annually

-

A+

-

AAA

-

None

-

Gold & Silver IRA

-

$10,000

$2,500 non IRA

-

$50

$180 Admin Annually

-

Variable

-

A+

-

AA

-

Free silver worth up to $5,000 on qualifying purchases

-

Gold, Silver, Platinum & Palladium

-

$10,000

$5,000 non IRA

-

80$

80$ Annually

-

$100

Annually

-

A+

-

AAA

-

None

Alternatives to Gold Broker

If Gold Broker Gold IRA is too “expensive” for you, consider the two cheaper alternatives below:

>>CLICK HERE to read our list of the top gold investing companies.<<

Alternative “Augusta Precious Metals”

Augusta precious metals are cheaper and a better option; they have well-equipped well-equipped educational materials for their interested clients. They make sure to provide their customers with the best investment option.

Alternative “GoldCo”

Goldco is undeniably one of the best gold and precious metals investment choices. They have 15 rich years of experience in the industry. They have good customer service that makes the investment process easier. Goldco has had deals with physical products with efficient prices. They have good customer reviews on each site.

How to invest in Gold Broker?

Here are the steps to follow if you want to invest in Gold Broker Gold IRA:

Here are the steps to follow if you want to invest in Gold Broker Gold IRA:

- Create a Gold Broker account: Fill out the registration form and provide the required documents to verify your identity.

- Place an order for the precious metals you wish to buy: Pick out the precious metal you wish to buy and choose your required service, either selling or buying. Enter your credit card number to confirm the order.

- Send money: Send the money to pay for your transaction made.

Do We Recommend Gold Broker?

Now, all the necessary information on Gold Broker is here for you to decide if this is the right company for you and your investments. As it is stated above, there are a lot of positive points to Gold Broker; for example, free shipping and insurance for every order, the company's buyback program and its secure storage options. However, due to the small number of customer reviews and a limited selection of precious metals, we have reservations about recommending them. The choice is yours. Will you choose to work with Gold Broker Gold IRA?

Our Verdict : 3/5

Gold Broker's FAQs

What is the minimum investment for Gold Broker Gold IRA Precious Metals Gold IRA?

The minimum investment is $10,000 on the first order and $5,000 on the second order.

What type of metals should I have with my Acre Gold IRA?

Gold Broker Gold IRA deals with Gold, Silver, Platinum and Palladium.

When would I be qualified for the Gold Broker Gold IRA distributions?

There is no specified age to be qualified to invest in Gold Broker.

Is there a buyback program for Gold Broker Gold IRA?

Yes. Gold Broker store their precious metals with their storage partner Malca-Amit and guarantee your investment liquidity. Anytime you wish to sell your precious metals, it is as easy as placing an order to sell all or some of your bullion. After your transaction is confirmed, they will liquidate the coins and bars, and the company will issue a wire transfer.

What storage options do I have with Gold Broker Gold IRA?

Gold broker partners with Maca-Amit, a trusted storage partner for individuals and financial institutions worldwide with high net worth.

Why would I need a custodian to handle precious metals in my Gold Broker Gold IRA?

The law has required hiring a custodian to manage the company’s assets.

Who is the custodian of Gold Broker Gold IRA?

Gold broker has two main custodians they work with. In Europe, their preferred partner is Rhenus. For swift logistics around U.S. IRA accounts, they are partners with Matterhorn Asset Management. All of their international storage options are kept through their affiliated partner Malca-Amit.

How long will it take to roll over my IRA to the Gold Broker Gold IRA?

It takes a day to complete the opening process of a new IRA. Delays may arise from the custodian of the transfer account. In that situation, a rollover may take two weeks or more.