How to Buy and Invest in Gold – A Complete Guide

Gold investing is a lucrative money-making opportunity, endeavor, or option. If you have money and don’t have an investment plan or idea, buy gold.

There are different ways to buy gold or invest in one. If you are an investor, the option(s) you go with will depend on the investment form you find suitable to your needs and financial circumstance. Additionally, the level of professional advice you get will ascertain your investment route.

The various gold investment options come with their risks and return profiles, fees, and liquidity characteristics. Your asset allocation strategy should consider short-term and long-term returns. It must also look at how the gold investment product can perform in a negative or positive correlation with assets.

The early paper currencies were generally backed by gold. Today you are given the right to buy futures contracts within a period. You buy shares like SPDR Gold Shares, the largest gold fund sold through a futures broker. The gold price can present in different currencies other than the U.S. dollar, and then you have to check on their content where you can convert to your currency.

Having that in mind, do you want to dip your hand in the investment world? The good thing, there are incredible choices for you – including companies that go public daily. You can trade gold as an investment option with a physical value. In this buying guide, you will learn how to invest in gold and silver – the ins and out.

Are you looking for a great investment opportunity? This guide will give you a quick crash course and teach you all you need to know about investing in Gold, what to look for, what to avoid etc….” What do you think?

Let’s get started:

- So, you are looking forward to investing in gold and adding it to your portfolio? How do you plan to do it?

- The simplest ways you can own gold is to buy gold bars or coins. However, you should store them securely.

- Other gold options to buy are mutual funds and ETFs, which help track actual gold prices.

- To have indirect gold, consider to invest in gold mining stocks. However, their shares prices don’t track the value of gold over the long run.

Table of Contents

How to buy gold

Are you interested to know how to invest in gold and silver? The first thing is to know how to buy gold. Most investors will prefer investing highly in gold in their diversification portfolio. This gives them a chance to make a considerable profit.

When you want to buy gold, you can buy in two forms. One is the physical gold, which comes in the form of gold coins or gold bullion. The other option to buy gold is in the form of securities and includes stocks in the form of mutual and ETFs. More about these options are explained further down in this article.

How do I start buying gold?

You may have thought of the finest ways on how to buy gold. Most investors now wish to know how to buy gold bars instead of intangible investments such as gold ETF. You browse gold bar products and select reputable websites with the quality and fair price of gold funds. You can as well find the exchange-traded fund that provides similar products and partners with them.

Online retailers give discounts when you buy gold in large quantities. They may prefer the use of credit cards as a mode of payment. Some may choose to own gold indirectly, futures contracts are highly leveraged, and risk choice that is in it.

How can l buy gold?

Here you need to know about Advertiser Disclosure containing reference information on products to buy and sell gold. Gold mining stocks tend to vary in ways with their prices. Note that expense ratios can also vary depending on the gold mining. You can invest in any amount of money to buy products that appear on the site, or you can choose a physical asset.

What do you need to know about gold investment?

The main reason why investors invest in gold bars is that it’s less expensive than gold coins and an easy process to learn how to buy gold bars. You need to check for mining companies that offer a more liquid and low-cost price of gold to invest. You can determine the price of gold every time, so to protect yourself against future price declines. Options are similar to futures, and they grant you to either buy or sell your assets.

As you look to dig into this gold market, you can check on savings advice, and you will find gold ETFs excellent with their value of one’s holdings. Check on the website for all the information concerning mining stocks and if they allow owning physical gold. Some gold mining companies boast extensive global operations that are high-risk and not recommended for beginners.

How do you buy gold stock? This is a different way of buying gold. It isn’t like visiting a store to purchase gold coins or jewelry. Before you can consider buying gold stock, there are types of gold investments to look at. You can therefore consider buying gold stock depending on the following options:

- Buying gold certificates.

- Solid gold jewelry

- Future contracts or trade gold Options

- Exchange-traded funds or gold mutual funds

- Physical gold bullion – as coins or bars.

Nevertheless, you are not limited to the above options only. You can choose to invest in stocks, especially those revolving around the gold industry – such as production, refining, and gold mining stocks. Keep in mind that, before you purchase gold stock, remember to understand how to buy gold stock and they tend to be volatile. That’s why you find most investors allocating funds to both traditional and gold stocks. It is a strategy that helps them hedge their investments. If you also invest in one type of stock, the chance of losing your money is high due to swings in the market.

Suppose you want to know how to buy gold stock. It’s an easy process. First, you need to have a trusted broker like Robinhood. If you choose to use this broker, you will find they have over 100 gold stocks you can choose. It is simple! Go to your Robinhood app and type the stock you want in the ticker symbol. Click buy and include the total shares you want to buy, and you’re done. Buying tends to be simple, but finding the gold stock to choose is hard.

Investing in gold stock is good. But make it part of your portfolio without sinking most of your investments into these stocks. They help in your investment because they will protect you against inflation. The challenge you come across is that you don’t get a fast return on investment.

Studies have shown that investing in gold stocks can provide you with a steady gain for a long time. Therefore, it would be best you get into gold stock investments as soon as possible. Your investment can continue to mature over decades, providing a safety net for retirement. According to financial experts, the term gold stocks is ideal for diversifying your portfolio stability.

How do you buy gold jewelry for investment?

The right moment to purchase gold jewelry is after researching the industry. When you go for jewelry, you pick a bracelet, ring, or necklace at a jeweler shop; you will overpay for its actual value. Retail jewelers will add big marks, which could make it years before the gold prices catch up.

To avoid such high costs, look for private sellers of gold jewelry – particularly not at auction. That jewelry on auction is priced and pre-appraised. It means you will buy more cost than the actual value. The best places to find gold jewelry at a good price are small private sellers, junk markets, or garage sales.

The value will depend on purity. Those pieces that have 99.99% purity are referred to as 24-karat, will be more expensive. Their value is equal to raw gold bullion. If it has low karat, it means the gold is less pure. If you choose to invest in gold jewelry, it’s a labour-intensive option. You can find valuable pieces when you find an owner who doesn’t see their value or consider them costume jewelry.

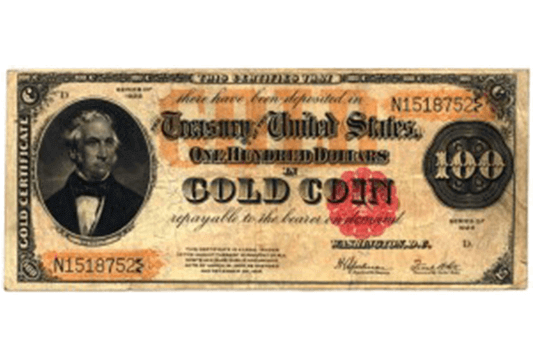

How do you buy gold certificates?

This is a document that can prove your ownership of the gold. In some countries like the U.S., gold certificates used to be gold-backed. The certificates were worth the amount indicated in the currency until the 1930s when they were abandoned.

Today, even after you get such an old certificate, you shouldn’t be excited. These documents have no collectible value remaining. You cannot use it to redeem any gold at the bank. On the other hand, we have not come to the end of certificates. You can buy gold certificates with physical gold from a bank. The bank will owe you the gold, technically, but in a real sense, you don’t own it. What you will have is unallocated gold because the certificate will represent the gold value – and not the gold bullion.

Since this is unallocated gold, it doesn’t need a high premium. It would be best you buy and keep it. And because you won’t be owning the physical gold, your bank will divest without your input. It will then reimburse you. On the other hand, the bank may go under and liquidate. This can be a worse situation as it allows you to lose your unallocated gold. Unfortunately, the bank will still own this gold, thus an easy way for you to lose your investment. You have a choice to make considering whether this type of investment is risky for you.

Alternatively, another way is to buy certificates having allocated gold. It means you own the physical gold. So, the bank gives you the serial number of your gold bars. However, remember that the bank will charge you an exorbitant fee because it has stored the gold for you in the vault. If you have purchased allocated gold, they belong to you and not your bank.

The advantage is that these golds can’t liquidate or be seized. And if you realize that your bank is failing, you can ask your allocated gold. The proof is the gold certificate you buy. Remember that you can store the gold yourself at a low cost instead of paying a bank for storage. You won’t be tied to the gold certificate.

How do you buy gold bullion?

Another type of gold option worth knowing is how to invest in gold bullion. You can get good prices of this type of gold at any price if you want to get the best deal by checking with a gold seller or dealer connected to the government mint. This ensures that the gold you receive real gold bullion. It is a type of gold that you receive in ounces or grams.

Buying physical gold bullion gives you a chance to have raw gold, and you can touch it with your hands. It will give you direct exposure. However, this is something you have to store safely due to emergencies. This is because gold bullion bars could be an excellent long-term investment option. Ensure that the gold you will buy is pure. It should be at least 99.5% pure.

Some common sites such as APMEX and JM Bullion are common for selling gold bullion. You are given an option of the currency you want to use to purchase gold. Most major currencies are accepted.

Another accepted option is to use cryptocurrency. While you plan to buy with accepted currency, check the exchange rates. This will ensure that the gold seller will not take undue advantage of you. Another thing, finding a reputable dealer allows you not to consider a third party for you to appraise the gold. If you buy from an unknown source, consider a 99.99% tamp mark that indicates the gold is obtained from appraisal and pure. Ending up with the fake type of gold bullion will be a significant loss on your investment.

Further, you can protect your investment -ask the seller about the buyback policy. This policy hinders the seller from charging you with a second premium after selling back to them. If you know how to invest in gold bullion, you know that the gold seller has to include a buyback clause.

How do you buy mutual funds and ETFs?

These are commodity funds you will find in the market. The first Gold ETFs were launched in 2003 in the Australian forex market and then followed by the U.S. Based in 2004. Gold ETFs will trade like stocks, and their assets are backed by gold. However, when you invest in these ETFs, you don’t have the physical gold. You have to invest in small quantities that are related to gold assets, thus suitable for diversification.

Most investors without substantial nest eggs will prefer to invest in gold ETFs. This is because they require smaller investments, unlike gold coins. When you buy these ETFs and mutual funds containing a share of gold miners, it helps you to avoid storing the physical commodity. It is easy to buy a gold ETF. The process is similar to normal stock. For example, if you choose to buy the SPDR Gold Shares, search for “GLD,” and you can find the needed information.

Another smart way to protect your investment from a hedge against economic shock and inflation is to choose a gold mutual fund. You can choose to diversify these to avoid huge losses in your investment.

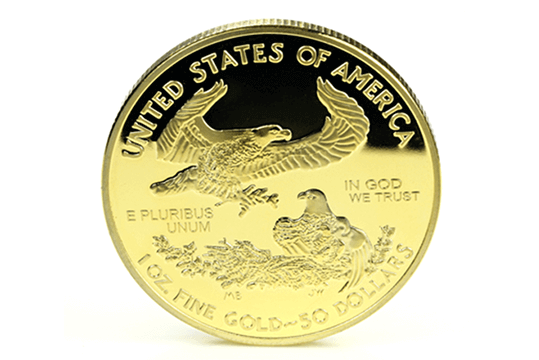

How do you buy gold coins?

If you want to invest in this option, know how to buy gold coins. There are two types: numismatic coins and sovereign coins. For a sovereign coin, it is backed by government mint with face value. However, if it’s raw gold, the face value will be higher. On the other hand, numismatic coins are more valuable. Avoid investing in these coins unless you’re a collector. When you collect rare coins, they won’t be liquidated easily because the coins aren’t easy to sell.

However, if you want to consider sovereign coins for investment, the best place to buy authentic coins is at the government mint authorized dealer. You can get various choices for these sovereign coins. Most of these popular gold coins, you can get include:

- Canadian Maple Leaf

- American Gold Eagle & Buffalo

- Australian kangaroo

- Australian Philharmonic

- South African Krugerrand

Similar to bars, with skills of how to buy gold coins, you can get them online or locally. You can also save up to buy bars of more substantial size.

How do you buy gold futures & Options?

Another type of gold investment you can make is to buy futures and options. This is a suitable option for investors who don’t want to risk a lot of money. Options are low-risk ways to play with the stock market. However, it becomes a risk when you don’t understand the market.

Taking advantage of Gold Options is when you are sure the selling price will move up or down. After the price goes in the opposite direction, it contains your liability. Your only risk with Options is the premium you pay for the Options contract. In this investment option, gold futures enable you to mitigate your loss or lock in your gain at any time. When you opt to purchase gold futures depending on physical gold, you will not take delivery. It means you wait until the end of a contract and eliminate the storage needs.

The future contracts work best for you if you are looking for flexible financial integrity. With gold investment, it can hold its value during market volatility, which will be the best option. After your gold investment, you can still bet on falling interest rates to maintain a good credit score. With gold fund investment, you greatly diversify your portfolio as you look for funds to acquire shares of mining companies.

When you visit a website dealing with any asset that is of value or dealing with any form of gold bar product, their prices may differ. You need to check on their main content, if you can, with their cookies. Most buyers check on the amount and currency without knowing, focusing on the company’s background.

Check on the golden features that give the buyers the derivatives to track the gold price. You need to master steps to access the derivatives market of gold’s price. When you have found your account, you will have access to the derivatives market in your brokerage account and allow the use of gold futures and options.

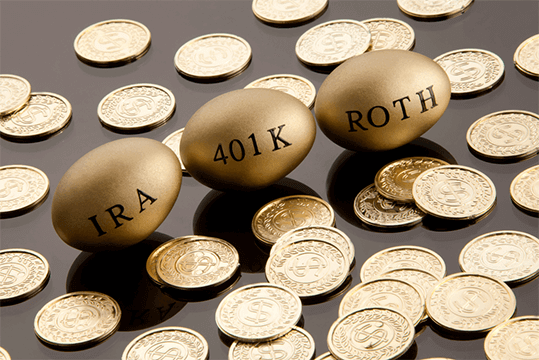

How to invest in gold with IRA/401k

You can use this self-directed employer-sponsored retirement saving option to invest in gold. The best way to invest in the gold wave is directly to the physical commodity. However, with 401(k), there are only a few plans that allow you to invest directly – particularly the gold bullion.

Follow this guide to rollover your 401k into a Gold IRA.

Majority of them will not allow you to buy gold coins or gold bullion directly. But, don’t be disappointed. You can invest in gold exchange-traded funds or mutual funds. Learn more about Gold IRAs

Our top rated Gold IRA companies include Goldco, Augusta Precious Metals, American Hartford, Birch Gold and Noble gold

The Final Word

If you want to earn good returns with your gold investment, long-term investment will be an excellent option. This is regardless of whether you choose gold stocks, futures, or physical gold. For success in your investment, gold shouldn’t be the only option to have in your portfolio. Consider diversifications to have a steady income.