Fidelity Gold IRA Review – Safe for Investment or Scam?

Read our full review on this gold company

Ranked #14 of 68

Fidelity

3 / 5

The best about Fidelity Gold IRA

-

Items for Long-Term Investing

-

Many Investing Options

-

Minimal transaction and service fees

-

Transfers between accounts are unlimited.

Ready to Protect Your Retirement Savings?

FidelityBefore we get started with this review:

-

It is difficult to pick a company you can trust with your hard-earned savings. We understand this, and that is why we create useful information to give you as much knowledge as possible before you make a decision.

To make comparing and choosing a company best suited to your needs as easy as possible, we have created a list of our highest recommended investment companies.

>>CLICK HERE to read our list of the top gold investing companies.<<

Look to see if Fidelity was selected to our list this year!

Or…

Get a FREE Gold Investing Packet from our #1 recommendation:

Fidelity Gold IRA Review

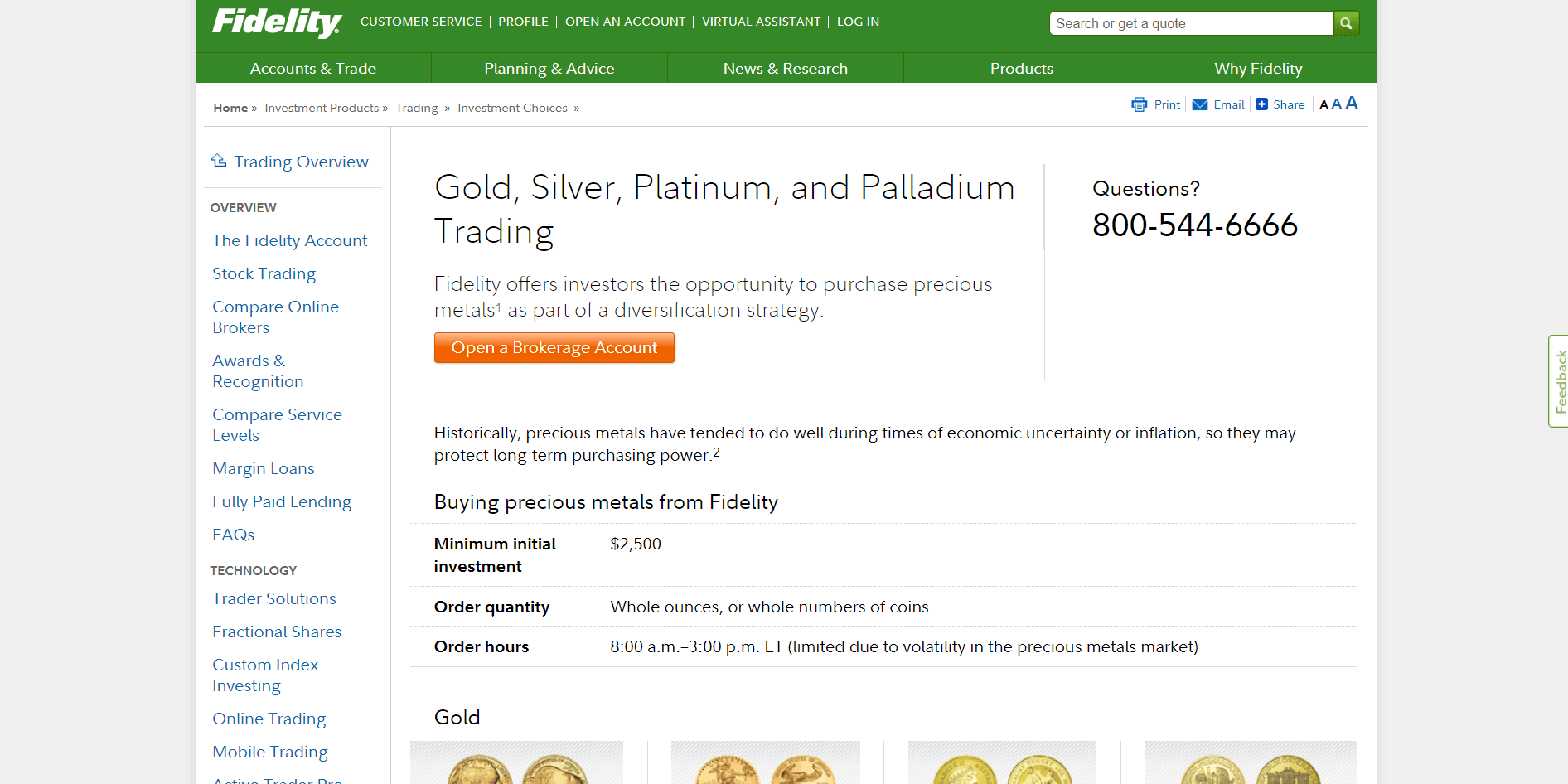

According to Fidelity, only five types of physical precious metals are available for your Fidelity Gold IRA: gold American Eagles in four denominations, gold American Buffalos, silver American Eagles, platinum American Eagles, and bullion bars in one denomination.

For your individual retirement savings and investment options, you can reach out to a Fidelity representative on 800-544-6666 if you can start with a quarterly storage fee and get some investment advice.

In other words, it is advised to meet with financial advisors about your individual retirement accounts, this will help in your wealth management and gain exposure to purchasing gold stocks and trading precious metals.

We have also suggested two precious metals sales alternatives websites that you can invest in gold to boost your retirement accounts. So, read through for more Fidelity investments and business ratings.

Gold IRA Fidelity Review:

Gold IRA Fidelity is a great choice for those who want to invest in gold. It has a low minimum investment amount, which makes it easy to set up your account.

Gold IRA Fidelity also offers a wide range of investment options that are suited to different kinds of investors. You can choose to invest in physical gold, or you can convert your IRA into a self-directed IRA and buy stocks and bonds as well.

The Gold IRA Fidelity team is also very helpful and knowledgeable when it comes to answering questions about their products. They're happy to provide advice on how best to use their products, what type of person would be well suited for them, and so on.

Fidelity selects a gold portfolio suitable for you. Gold mining stocks like the gold bullion bars is99.5%–99.99% pure, well, you can consider it as the precious metals Fidelity.

Personalized Investing: Fidelity provides personalized investing methods that can help you increase returns and more easily manage risk if you have $200,000 or more in assets with them.

Retirement Planning: Fidelity provides several retirement planning choices, including individual and employer-sponsored plans.

Asset Management: You can work with a professional wealth manager to establish a unique financial plan if you have an individual investment of more than $200,000 and a net worth of more than $1 million (excluding your primary residence).Brokerage Services: Fidelity provides an online and offline platform for you to buy and sell investments.

Review of Gold IRA Fidelity Overall Rating: 3.3/5

Our overall rating for Fidelity Gold IRA is 3.3/10 stars. The best part of Gold IRA Fidelity is that they offer you the chance to choose whether you want to invest in physical gold or in a digital gold account. You can also choose whether your investment will be held in one of their physical vaults or if it will be held on an online platform.

The next best thing about Gold IRA Fidelity is that they have great rates on their services and that they charge you very little for using their services.

Gold IRA Fidelity Pros & Cons

Benefits

-

Long-term Investment Products: Golds are the best retirement funds you can get. In fact, gold is a good long-term, buy-and-hold investment because you typically don't touch the money in an IRA until you retire, which makes gold a good fit for an IRA.

-

Tax Advantages: Contributions to traditional self-directed IRAs are tax-deductible. Whereas, contributions to gold IRAs are not tax-deductible. In addition, qualified Roth withdrawals are tax-free.

-

Absolute Control: Fidelity Gold IRAs are indeed self-directed, meaning you handle all investment choices and actively manage your assets.

-

Multiple Investment Options: They also offer a variety of different options when it comes to investing in gold.

-

Transaction fees: Low fees and transaction fees

-

Unlimited transfers between accounts

Disadvantages

-

Higher Rate of Fees: Physical Gold cannot be kept at home or in a bank's high-security vaults. However, you must pay a custodian to buy, ship, and transport the precious metals in your IRA, as well as store and insure them. Custodian fees for gold IRAs are sometimes higher than those for traditional IRAs.

-

Financial Restrictions: Bear in mind that no precious metals you currently own may be transferred to your gold IRA. You cannot individually purchase precious metals and transfer them to your IRA either. All transactions must be handled by a custodian on your behalf.

-

No Tax Benefits Received: There are no interest, dividends, or other returns given on gold bullion. Indeed, it doesn't fully benefit from the tax-free growing feature of IRA investment. Only capital gains from selling your gold at a profit would qualify for a tax benefit.

Gold IRA Fidelity Gold IRA Service Review: Key Summary

| Experience | Gold IRA Fidelity has been in business since 1946. They help over 40 million people with 57,000-plus associates in North America, Europe, Asia, and Australia. |

| Website | The company controls a website that is user-friendly that is easy to navigate. |

| Client Education | Gold IRA Fidelity offers various educational materials, such as; news and research, planning and advice, accounts and trade information, etc. Click here to access their educational material. |

| Customer Service | The majority of customers complain of poor customer service assistants. |

| Available Precious Metals Offer | They deal on precious metals like: Gold Coin, Silver Coin, Platinum Coin, Bullion Quality Bars |

| Physical Storage | Fidelity holds no inventories; they only serve as agents. |

| Other Investments Available | They also offer: Retirement, Saving & Investing for a Child, Charitable Giving, Philanthropic Consulting, Life Insurance & Long-Term Care Planning. |

| Annual Fees | Fidelity will charge you a minimum investment fee of $2,500 and a minimum fee per precious metals transaction of $44. |

| Trust link Rating | 2.8/5 |

| Consumer Alliance Rating | AAA |

The Bottom Line

Fidelity as a precious metals dealer, provides a variety of products and services that enable investors to purchase physical gold. ETFs, individual equities, and a retirement plan that invests in gold, silver, and other precious metals are examples of these.

For its gold items, the firm does not charge any commissions or fees. Furthermore, Fidelity does not levy account fees.

However, the only method to obtain exposure to gold in your portfolio is through "paper" gold financial products, not physical gold bullion.

Product Range and Services

Gold IRA Fidelity offers a wide range of Precious Metals. Stocks, funds, and ETFs are just a few of the gold-related products that are available from Fidelity.

Gold

- Gold American Buffalo:99.99% pure, $50 USD - 1 oz.

- Gold American Eagle Coin: 91.6% pure

- Gold Bullion Bars:99.5%–99.99% pure

Silver

- Silver American Eagle: 99.9% pure $1 USD 1 oz.

- Silver Platinum and Palladium: Platinum American Eagle99.95% pure

Among the top choices are:

- Traditional IRAs

- Precious Metals

- Individual Stocks

- Exchange-Traded Funds

- Mutual Funds

Pricing: Gold IRA Fidelity Gold IRA Costs/Fees

Fees: The minimum fee per precious metals transaction is $44.

Buying

| Gross amount | Percent charged on gross amount |

| $0–$9,999 | 2.90% |

| $10,000–$49,999 | 2.50% |

| $50,000–$99,999 | 1.98% |

| $100,000 | 0.99% |

Selling

| Gross amount | Percent charged on gross amount |

| $0–$49,999 | 2.00% |

| $50,000–$249,999 | 1.00% |

| $250,000+ | 0.75% |

Minimum Investment

The minimum initial investment in Gold IRA Fidelity is $2,500.

- Order quantity: Whole ounces, or whole numbers of coins

- Order hours: 8:00 a.m.–3:00 p.m. ET (limited due to volatility in the precious metals market

Customer Care

For more information to buy gold call the customer care number 800-544-6666 and to buy other precious metals or to learn more.

Company Reliability

What's the big deal about Fidelity, and how reliable is their gold IRA? To begin with, they are a management company for investments worth more than $4.9 trillion.

Indeed, Fidelity does not specialize in precious metals IRAs or in IRAs in general. If you have an employer-sponsored plan, like a Silver IRA, Fidelity probably designed it and pitched it to your employer.

Gold IRA Fidelity Educational Materials

Fidelity provides customers with valuable education material to guide them on their investment plans. They provide materials like:

- News

- Marketplace solutions

- Building savings

- Planning and advice etc.

Fidelity Company History and Background

Gold IRA Fidelity has been in business since 1946. They help over 40 million people feel more secure in their most critical financial objectives, manage employee benefit programs for roughly 23,000 organizations, and provide innovative investing and technology solutions to over 3,600 advising firms to help them expand their businesses.

Fidelity's diverse operations and independence provide us with insight into the whole market as well as the stability required to think and act in the long term while providing value to you.

Customer Reviews

Customers from review websites claim a zero-fee charge for many of their services such as; debit card, check book, wire transfer, ATM withdrawals and selling a large number of securities.

Therefore, Fidelity provides excellent customer support. They don’t sell your information, which provides a better chance for a better pricing on sales of securities.

Complaints

The majority of customers attest to zero issues getting out money. However, some claim that it provides the worst services and the brokers at their call centers are sometimes rude. Most customers also complain of delay of service here.

Fidelity Gold Independent Third-party Customer Review

Fidelity is one of the most trusted financial institutions in the world and it is no coincidence that they have such great customer service.

To this day, Fidelity has earned an A+ rating from the Better Business Bureau (BBB). The BBB reports that Fidelity has received just over 100 complaints in the past three years about its customer service practices and about 60% were resolved satisfactorily by Fidelity. That means there were only about 30 complaints per year out of more than 1 million accounts. The majority of these complaints were about mistakes related to withdrawals from IRAs or 401(k)s.

Average star ratings

-

BBB: A+

Money Metals Exchange vs the competition

Fidelity

Best Customer Reviews

-

Gold, Silver, Platinum & Palladium

-

$10,000

$5,000 non IRA

-

80$

80$ Annually

-

$100

Annually

-

A+

-

AAA

-

None

-

Gold & Silver IRA

-

$25,000

$3,500 non IRA

-

$50 + $30

$100 Admin Annually

-

$150 Segregated

$100 Non Segregated

-

A+

-

AAA

-

Get 10% back in FREE silver

-

Gold, Silver, Platinum & Palladium

-

$50,000

$50,000 non IRA

-

$50

$200 Admin Annually

-

$125

Annually

-

A+

-

AAA

-

None

-

Gold & Silver IRA

-

$10,000

$2,500 non IRA

-

$50

$180 Admin Annually

-

Variable

-

A+

-

AA

-

Free silver worth up to $5,000 on qualifying purchases

-

Gold, Silver, Platinum & Palladium

-

$10,000

$5,000 non IRA

-

80$

80$ Annually

-

$100

Annually

-

A+

-

AAA

-

None

Alternatives to Fidelity Gold IRA

If Fidelity Gold IRA is too “expensive” for you, consider the two alternatives below:

>>CLICK HERE to read our list of the top gold investing companies.<<

Alternatives to Fidelity Gold IRA:

Augusta Precious Metals

We consider these precious metals companies reliable based on their securities and exchange commissions. Therefore, they offer smooth precious metal transactions.

Augusta Precious Metals is a gold IRA company that offers physical metals, paper gold, gold ETFs and wealth management services.

Despite the fact that Augusta has only been in operation since 2012, as opposed to Fidelity's almost century, the people behind it have decades of expertise

Alternative: Goldco

Located in the Los Angeles region, Goldco is a privately held company with more than ten years of expertise assisting clients in safeguarding their retirement funds.

A Goldco Specialist can assist you in smoothly completing the procedure, whether you wish to buy gold and silver directly or diversify your retirement assets into a Precious Metals IRA.

Therefore, Goldco Specialists can help you safeguard those assets with a Precious Metals IRA if you have an IRA, 401(k), 403(b), TSP, or other tax-advantaged retirement account of a similar nature.

Only Goldco is endorsed by prominent public figures such as Sean Hannity, Chuck Norris, Ben Stein, and Stew Peters. They are proud to tell their audience, family, and friends that Goldco is the only company to buy precious metals from.

How to invest in Gold IRA with Fidelity

Precious metals markets made through IRAs are subject to federal restrictions and rules. In a Fidelity IRA, only the following precious metals may be bought:

- Gold American Eagle (1 oz, 1/2 oz, 1/4 oz, and 1/10 oz)

- Gold American Buffalo (1 oz)

- Silver American Eagle (1 oz)

- Platinum American Eagle (1 oz)

- Bullion Quality Bars

To begin investing with Fidelity Gold IRA visit their website.

Do We Recommend Gold IRA Fidelity?

Yes, they assist roughly 40 million consumers in becoming more certain about their most financial objectives.

Additionally, they oversee employee benefit plans for approximately 23,000 companies and provide more than 3,600 advisory firms with cutting-edge investing and technological solutions to help them expand.

Our Verdict : 3.3/5

Gold IRA Fidelity's FAQs

What is the minimum investment for Gold IRA Fidelity Precious Metals?

The minimum investment for Gold IRA Fidelity precious metals is $2,500

What typWhat type of metals should I have with my Gold IRA Fidelity?e of metals should I have with my Gold IRA Fidelity? Fidelity offers precious metals like; Gold silver platinum, gold ETFs, and other precious metals.

Fidelity offers precious metals like; Gold silver platinum, gold ETFs, and other precious metals.

When would I be qualified for the Gold IRA Fidelity distributions?

The appropriate amount to start investing with or to add each month depends on your income, budget, and other financial objectives.

You might want to think about beginning small. In fact, you may invest as little as $1 in fractional shares at Fidelity if you’re interested in purchasing stocks or ETFs.

What storage options do I have with Gold IRA Fidelity?

Customers’ bullion or coins are safeguarded against theft and disappearance at FideliTrade or ScotiaMocatta.

FideliTrade and ScotiaMocatta both have $1 billion in “all risk” insurance coverage at Lloyds of London for bullion stored in their high-security vaults, as well as $300 million in contingent vault coverage.

Why would I need a custodian to handle precious metals in my Gold IRA Fidelity?

A custodian will be responsible for your gold transactions, advice and direct you on how you can go about your investment.