iTrustCapital Review – Is it a Scam or Not?

Read our full review on this gold company

Ranked #17 of 68

iTrustCapital

3 / 5

The best about Advantage Gold IRA

-

Outstanding client service

-

Simple account creation, trading available 24 hours a day, seven days a week

-

Platform that is completely regulated

-

Knowledge Center provides educational materials.

Ready to Protect Your Retirement Savings?

iTrustCapitalBefore we get started with this review:

-

Choosing a business you can rely on with your precious savings is challenging. We are aware of this, which is why we produce informative content to provide you with as much knowledge as possible before making a choice.

We have compiled a list of our top-rated investing firms so that comparing and selecting one that best meets your needs will be as simple as possible.

>>CLICK HERE to read our list of the top gold investing companies.<<

Look to see if iTrustCapital was selected to our list this year!

Or…

Get a FREE Gold Investing Packet from our #1 recommendation:

iTrust Capital Review

ITrust Capital is a high-quality, transparent and reputable IRA custodian. They offer a full suite of investment services, including: Gold IRA Accounts, Silver IRA Accounts and Platinum IRA Accounts. In addition to these investment account services, they also provide a gold IRA rollover service that allows you to roll over your physical gold or silver into an ITrust Capital Gold IRA account.

If you have physical gold or silver that you want to move into a self-directed IRA account, this is an easy way to do it. In fact, we think it's one of the best ways for people who want to make their own decisions about how and where they invest their money.

iTrustCapital is a self-directed Individual retirement account, that allows investors to select several alternative assets ranging from cryptocurrencies (crypto IRA) to precious metals. Its Gold IRA is the better investment platform for people looking to invest the barest minimum, paying the most negligible fees with tax-free or tax-deferred retirement accounts. Investors enjoy 1:1 ownership of their gold assets stored securely, with an indisputable title to their holdings. This iTrustCapital review aims at helping you decide if it is the right choice for you.

iTrustCapital Review

ITrustCapital is a well-known firm among investors and traders. They are offering their services to people who are looking to invest or trade in gold. The company offers clients a wide range of investment options, including traditional IRAs, Roth IRAs, 401(k) plans and other types of retirement accounts.

ITrustCapital has been providing great service to its customers for years now. They are known for being one of the best firms providing financial services in the world.

ITrustCapital offers an extensive range of investment options for their clients. The company has made a name for itself by offering some of the best investment opportunities available on the market today. Their website is one of the most popular websites used by investors throughout the world. This makes it easy for them to find what they need when they want it most.

Review of iTrustCapital: Overall Rating: 3/5

iTrustCapital Pros & Cons

Benefits

-

Partnership with VaultChainTM provides maximum security for assets.

-

Lowest minimum investment amount of $1000.

-

Trading fees are almost next to zero, plus tax-advantaged retirement account.

-

Friendly interface for beginner investors.

-

Utilizes blockchain technology to track and audit assets at all times, making the platform transparent.

-

1:1 ownership of gold and silver assets even without physical contact right in your iTrustCapital account.

-

Physical precious metal bars can be delivered to any location upon request.

Disadvantages

-

Lack of a financial expert in the team.

-

The non-availability of a mobile app limits easy access and management of assets.

iTrustCapital Review: Key Summary

| Experience | Offering service to over 185k accounts and completing over $6 Billion in transaction volume says so much about the reliability of their service and Experience in managing IRA. This legacy they’ve built in the space of 4 years and counting. |

| Website | The iTrustCapital website is built with easy navigation in mind. It bears clear-cut information on every page that builds trust and brings clients and visitors to continue investing in their platform. |

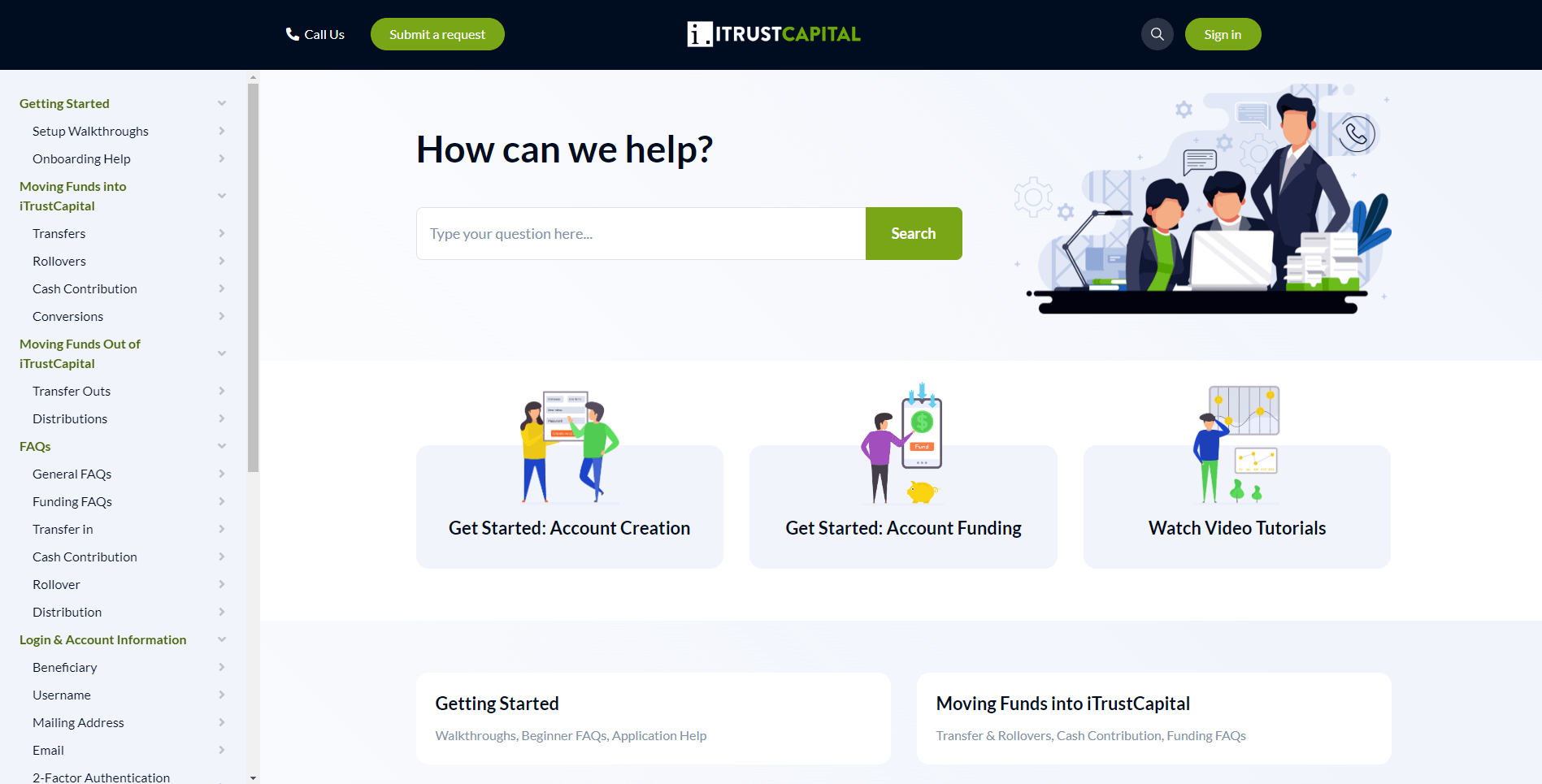

| Client Education | From learning the basics of IRA investing, to how to invest, retirement education and periodic updates to their service, could all be found in their well-curated learning center right on their website. Hardly would you find any information missing, and if you have any difficulty grasping any concept, be sure to forward it to the support team who will clear the cloud in no time. |

| Customer Service | You also get to enjoy active legendary support whenever you need it. Their Phone line is as hot as their support email address. |

| Available Precious Metal Offer | iTrustCapital only offers two precious metals - Gold and Silver. This is primarily because both metals have shown to be consistently valuable and stable over time. Although there are speculations that more physical precious metals could be featured in future. |

| Physical Storage | All precious metal value in every account is backed up with a corresponding equal weight of physical metal stored in the Royal Canadian Vault. Hence, you have the option to receive in your location physical precious metals upon request. |

| Other Investments Available | Other than investing in Gold and Silver, iTrustCapital also offers Crypto IRA. This allows clients the ability to own and transact digital currencies right from their account dashboard. |

| Annual fees | It may interest you to know that iTrustCapital charges no annual fees. This separates them distinctively from other IRA companies charging a premium annually for their services. |

| Trustpilot Rating | 4.4/5 |

| Better Business Bureau Rating | AAA |

The Bottom Line

Trustworthy IRA companies are marked by their ability to provide straightforward information on how to continue investing plus open pricing to help you decide with little difficulty. iTrustCapital has checked these boxes and many more in our comparison with other Gold IRA companies.

If you are a sole proprietor or running an SME, iTrustCapital may be the best retirement investment platform for you or your firm.

Our biggest draw to them includes their investment account minimums and quality customer representative service to guide investors every step of the way.

Product Range and Services

iTrustCapital Gold IRA offers a wide range of Precious Metals. Other self-directed IRA accounts, hosted by other companies allow the buying and selling of gold and providing crypto IRA. iTrustCapital has moved a step further by introducing one more precious metal - Silver, keeping them at the top of their game.

This they have made possible by striking a solid partnership deal with Kitco metals - a dealer of precious metals including gold and silver assets. They utilize the power of blockchain to make the ownership and transaction of digital assets efficient and fully transparent.

Kitco Metals has been in business since 1977 and is a partner of the Royal Canadian Mint. Hence there’s no disputing their prowess in dealing with Gold and silver.

An account on iTrustCapital's platform makes it possible to own full title holdings to any amount of gold or silver right from your dashboard. True to their word - you don’t have to go through any third party that makes unit acquisitions expensive with high fees.

iTrustCapital Gold IRA Services

Gold IRA account

It’s never been easier investing in gold than with iTrustCapital.

From your account dashboard, you can buy and sell gold assets in minutes. The best part is that you do not have to go through a third party for all your acquisition.

Plus, you'd only have to fund your iTrustCapital account with as low as $1000 to begin transacting Gold.

Silver IRA account

Blockchain-enabled Silver transactions made available by VaultChainTM have made the silver market robust on iTrustCapital.

With the ease of access, acquisitions starting from as low as $1000 are possible and there’s no limit also to how much of the asset you can have in your retirement portfolio.

Note also that for every Silver acquired, there is an equivalent physical bar stored at the Royal Canadian Vault.

401 (k) Rollover

Your employer may set up a retirement investing account for you and this account may need transferring to a personal account after retirement or at any time specified by the employer.

The 401(k) rollover works to solve this. Employer-sponsored plans can be rolled over in a maximum period of 3 - 4 weeks, however, only a minimum plan of $1000 can be rolled over. This is applicable regardless if it's a gold or crypto IRA account.

Generally, you have to be up to 59 years old and a half. Make sure also to speak with your plan administrator to find out what your full options are.

Traditional and Roth IRA

If you’re self-employed, choosing between these two products offered by iTrustCapital may be the best for you.

The major difference between traditional and Roth IRA is in their tax timing, here’s how; for traditional IRA, funding is made with pre-tax dollars, reducing the amount of taxable income.

Whereas in Roth IRA, funding is made with post-tax dollars, hence no immediate tax build-up is imposed. making gain accrued on the plan tax-free when taking a distribution.

If you somehow know that you may be enclosed in a higher tax-paying bracket come retirement, then the Roth IRA may be your best bet.

Consult with a financial advisor to discuss what plan is best for you.

SEP IRA Planning

Also known as Simplified Employee Pension (SEP IRA), small businesses and self-employed individuals can make the most of this iTrustCapital service.

Usually, SEP IRAs have a higher annual contribution limit of up to $61k as of 2022.

For this account, the individual or business is allowed a certain tax deduction, enjoys tax-deferred gains and is taxed once an eligible distribution is taken.

Simple IRA planning

Great for businesses with fewer employees - less than 100 or fewer. The draw for many employers to this plan is its ease of setup. For this account, unlike Roth IRA, a non-elective contribution of up to $14,000 annually is possible as of 2022. Mostly this total sum is an aggregate of 2% of the employee’s monthly salary.

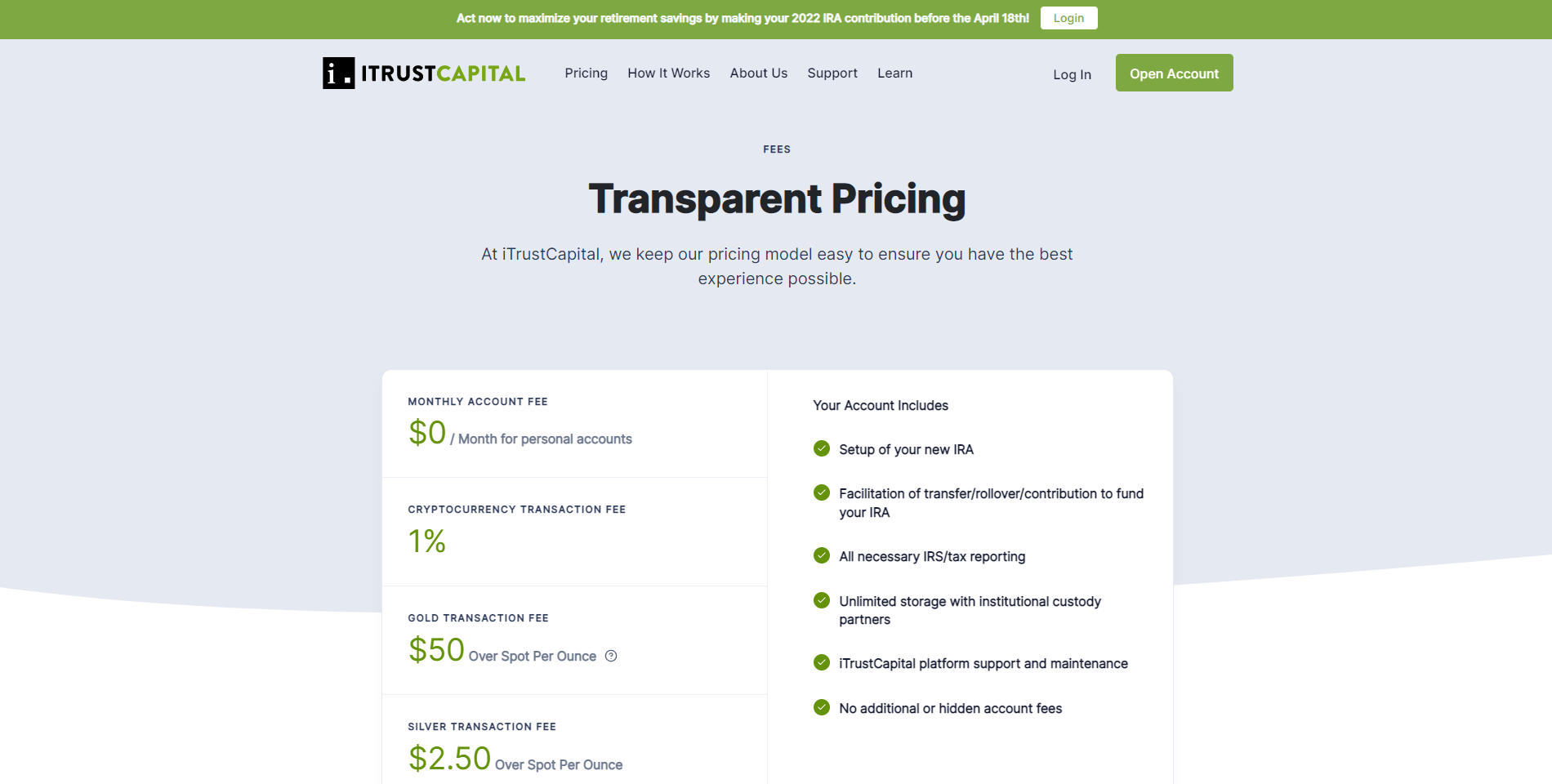

Pricing

iTrustCapital Gold IRA is great value for money. iTrustCapital is a definition of a typical near-cost-free IRA platform. Compared to other companies offering Gold IRA, it has the lowest fees and is an excellent value for money.

Usually, you’re to expect a custodian and storage fee close to or more than $100 with a traditional IRA, but these do not apply for iTrustCapital.

You simply acquire your Gold, and trade whenever tax-free or tax-deferred.

iTrustCapital Gold IRA costs/monthly fees

It’s important to note that there are no monthly maintenance fees associated with iTrustCapital, making it one of the most cost-effective IRAs.

Also, you’re not charged any special fee for the storage of your asset or maintenance.

No hidden account fees, the only fee you pay on your iTrustCapital gold IRA is applicable when you carry out a gold transaction. This breaks down to $50 over spot per ounce.

Minimum investment

You wouldn’t need a great deal of money to invest, with as low as $1000, you can get started with investing in gold on the iTrustCapital gold IRA.

This investment price tag is not obtainable with most other gold IRAs. In fact, some IRA have their account minimums at $50,000 making them too far-fetched.

iTrustCapital Gold IRA Review: Customer Care

iTrustCapital Gold IRA offers customized service and education. There are several tailor-made plans on iTrustCapital that fit your need - whether as a small business or self-employed.

Make sure however to consult with a financial advisor if you’re not sure what plan works best for you. Usually, your choice will revolve around the tax-timing advantage.

iTrustCapital also tries to educate its investors to the best of its ability. They do this by curating, publishing and updating in-depth articles concerning Gold IRA on their blog.

iTrustCapital Gold IRA Educational materials

From how to get started with Gold IRA, to the knowledge of blockchain that makes ownership of Gold assets possible have been covered by iTrustCapital.

Usually, these resources are easily available in the learning centre right on the iTrustCapital official website.

You may also get occasional newsletters aimed at keeping you informed about Gold IRA's best practices.

Company Reliability

iTrustCapital Gold IRA has been in business since 2018. Having served the public for more than 4 years, it’s safe enough to say that iTrustCapital has come to stay.

From proven statistics, they have also completed over $6 billion in the total volume of transactions. This easily explains why over 185,000 persons have chosen them for their IRA.

iTrustCapital Gold IRA Company history and background

The self-directed IRA platform was founded by Todd Southwick, with Blake Skadron as the co-founder in 2018.

Both founders worked together for the most part in building and developing the company. Not until sometime from the time of creation did more brilliant minds join their team - the likes of Chris Frank (Financial Officer), and Kathleen Policy (General Counsel).The company has its headquarters currently in Irvine CA, and its branch office in Agoura Hills LA.

iTrustCapital Gold IRA Review: Customer Reviews

iTrustCapital Gold IRA is top-rated by clients. The US populace has had their say about iTrustCapital and they’re full of praise.

The IRA company has garnered over 2000 5-star reviews from trusted platforms like Trustpilot and Google.

This does say so much about the company and is a strong indication that they’ve come to stay.

iTrustCapital Gold IRA independent 3rd party customer reviews

Several reliable third parties have written extensively on iTrustCapital IRA review, basing their consideration on several factors including key comparisons to other Gold IRAs.

From an analysis we carried out, it was found that 6/8 rated iTrustCapital over 4.0/5.0 - This was among top authority websites like BusinessInsider.com, Banks.com etc.

Average star ratings

-

BBB: AAA

-

Trustpilot: 4.4/5

iTrustCapital vs the competition

iTrustCapital

Best Customer Reviews

-

Gold, Silver, Platinum & Palladium

-

$10,000

$5,000 non IRA

-

80$

80$ Annually

-

$100

Annually

-

A+

-

AAA

-

None

-

Gold & Silver IRA

-

$25,000

$3,500 non IRA

-

$50 + $30

$100 Admin Annually

-

$150 Segregated

$100 Non Segregated

-

A+

-

AAA

-

Get 10% back in FREE silver

-

Gold, Silver, Platinum & Palladium

-

$50,000

$50,000 non IRA

-

$50

$200 Admin Annually

-

$125

Annually

-

A+

-

AAA

-

None

-

Gold & Silver IRA

-

$10,000

$2,500 non IRA

-

$50

$180 Admin Annually

-

Variable

-

A+

-

AA

-

Free silver worth up to $5,000 on qualifying purchases

-

Gold, Silver, Platinum & Palladium

-

$10,000

$5,000 non IRA

-

80$

80$ Annually

-

$100

Annually

-

A+

-

AAA

-

None

Alternatives to iTrustCapital

If iTrustCapital Gold IRA from what he have so far said doesn’t sound like the right gold investment platform for you, consider the two iTrustcapital alternatives below;

>>CLICK HERE to read our list of the top gold investing companies.<<

Alternative 1- Augusta Precious Metals

Augusta Precious Metals is a top-rated self-directed IRA provider company has stood the test of time and has been in business since 2012 offering traditional or Roth IRA.

They have a reputation for choosing practical steps of educating their investors on every side as touching on investing in gold with written and video resources.

However, the only caveat is the high-priced investment minimum of $50,000 and other transaction fees which include;

- A one-time setup fee of $50

- An annual custodian fee of $100

- An annual depository fee of $100

Hence, the average setup cost goes up to about $50,250 for the first year, which is relatively high-end pricing compared to other Gold IRA companies.

Be sure however to enjoy 24/7 support, high stability plus the services of a professional Harvard Economist to answer all your financial questions.

This IRA is suitable for big businesses or sole proprietors with a commensurate annual income.

Alternative 2 - Goldco

The company is a prominent authority when it comes to self-directed IRAs, especially because of its over 15 years experience in managing the retirement accounts of thousands of people.

Goldco teaches every investor that investing in more stable precious metals is the best for a retirement account, they have stuck to this ideology by providing majorly the buying and selling of Gold and Silver.

In terms of providing information on how to get started with investing in Precious metals, they have a fully updated blog that you can rely on to find every helpful resource that you may need.

One of their best features is the ‘Buy Back' program that has removed all hassle when it’s time to take a distribution. The Buy Back program puts you in a position to sell your Gold for profit to the company without having to find a buyer yourself when you’re eligible for a distribution.

The minimum that can be invested is $15,000. Below are a few red flags that you may want to take note of;

- Navigating their pricing information is not easy on their website.

- Not enough information about storage or monthly fees, hidden fees may apply.

- Not enough information on how much fees that the custodian charge.

To be safe, before investing, be sure to consult with a representative to get a full scope of their Gold and Silver IRA.

How to invest in iTrustCapital?

Investing in Gold is made super easy with iTrustCapital. In only three steps you can get started with investing in Gold for your self-directed IRA. Follow the simple steps outlined below;

Create an account on iTrustCapital.com. Creating an account only takes less than 2 minutes. You’ll be asked to enter a valid email address and mobile number amongst other details.

Fund your account. There are several ways to fund your iTrustCapital account. They include;

- Transferring funds or assets held by another IRA custodian to iTrustCapital. This process may usually include signing a form afterwards the transfer will be initiated and completed in 7 - 14 days.

- Another Funding method is to roll over an Employer IRA plan if applicable to you, which takes 14 - 24 days from start to finish.

The last method is the contribution of new funds in USD. Depending on your age, you may be limited to a particular amount. Usually, if you are more than 50 years of age, you’re eligible for more contributions, up to $7000. This can be a bank wire transfer or check. This process completes in 7 days.

Do We Recommend iTrustCapital?

Yes, we have based this decision on several factors that have been discussed above. Some of our top draw to iTrustCapital FDIC insured include;

- Cheap pricing with a minimum investment amount of $1000

- No monthly fee ever!

- No setup fees

An active support team.

Our Verdict : 3/5

iTrustCapital's FAQs

What is the minimum investment for iTrustCapital Gold IRA Precious Metals Gold IRA?

$1000 is the minimum investment amount for iTrustCapital. While there is a specification for minimum, there’s no maximum amount that can be invested.

However, note that the maximum amount payable by each investor depends on their IRS limitation for cash contributions.

What type of metals should I have with my iTrustCapital Gold IRA?

Gold IRA on iTrustCapital affords you the opportunity to own physical gold and silver. This is great, especially for investors who want to diversify their retirement assets.

When would I be qualified for the iTrustCapital Gold IRA distributions?

Usually, you’ll be required to be aged 59 and 1/2 before you’re able to take an eligible distribution on the iTrustCapital platform. Taking a distribution from your individual IRA before this age attracts a 10% added tax penalty.

However, the IRS has stated a few exceptions to this. One of such is if you take a distribution to pay for a medical insurance premium after a job loss before age 59 and 1/2. Other exceptions have been specified by the IRS, visit their website to find out more.

Is there a buyback program for iTrustCapital Gold IRA?

No, at the moment, there is no buyback program available on the iTrustCapital IRA platform. You’re required to liquidate your gold or silver first before requesting a distribution, otherwise, you can also request an ‘in-kind’ distribution.

What storage options do I have with iTrustCapital Gold IRA?

All precious metals you acquire are backed-up with an equal weight of Gold or silver at the Royal Canadian Mint – this is the official storage location. However, you can make a special request to have your precious metals delivered to you and you can store them as you deem fit.

Why would I need a custodian to handle precious metals in my iTrustCapital Gold IRA?

Yes. While iTrustCapital states clearly that they’re not a custodian, however, the Royal Canadian Vault is. They’re charged with the responsibility of holding, protecting, updating, executing and reporting every transaction.

Who is the custodian of iTrustCapital Gold IRA Precious Metals Gold IRA?

The Royal Canadian Vault. They’re answerable to the IRS for a yearly audit which makes them an eligible and trustworthy custodian.

How long will it take to roll over my IRA to the iTrustCapital Gold IRAs Precious metals Gold IRA?

60 days. You have this duration from the day you receive a plan distribution probably from your existing employer plan or an existing IRA to roll it over to a gold IRA on iTrustCapital Inc.